Archer-Daniels Midland Stock: Investment In Leading Global Agricultural Processor

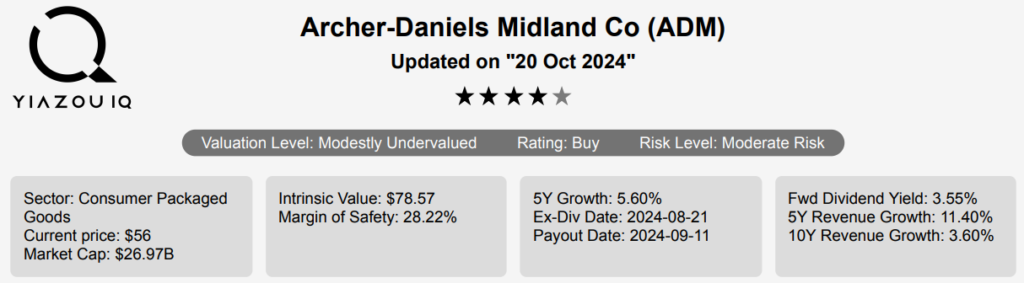

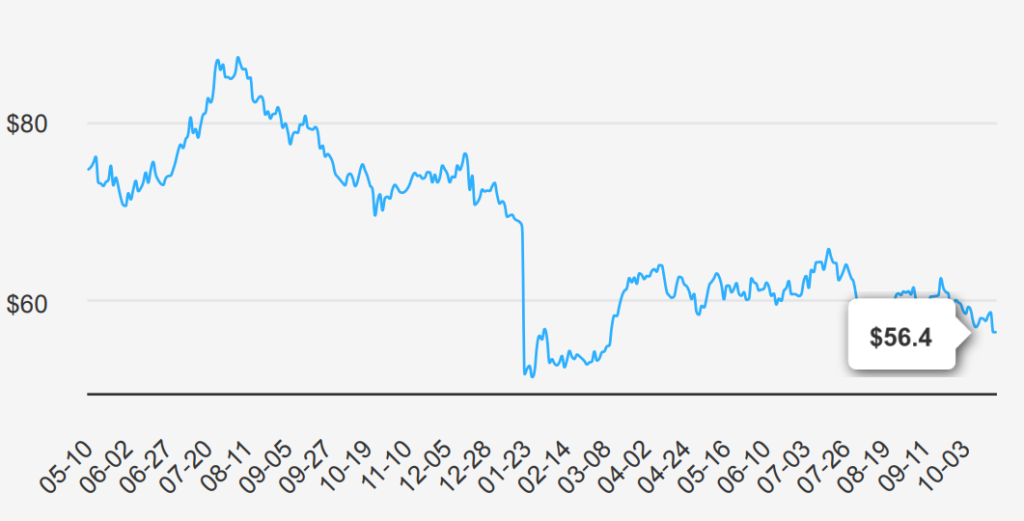

Archer-Daniels Midland (ADM) is a major processor of oil seeds, corn, wheat, and other agricultural commodities. The company is also one of the largest grain merchandisers through its extensive network of logistical assets to store and transport crops around the globe. ADM also runs a nutrition business that focuses on both human and animal ingredients and is a large producer of corn-based sweeteners, starches, and ethanol. ADM stock is currently trading at ~$56. Lets assess ADM stock outlook.

ADM Earnings Report: Q2 2024 Performance and Projections

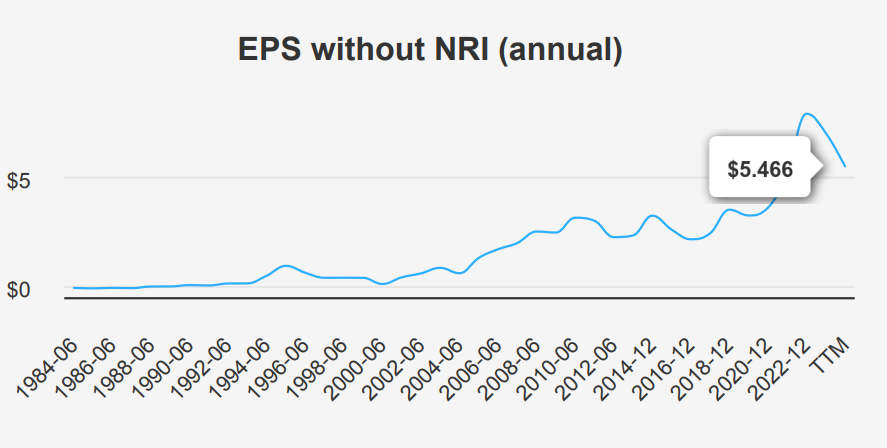

ADM reported earnings per share (EPS) without non-recurring items (NRI) of $1.03 in the second quarter of 2024, reflecting a decrease from $1.46 in the previous quarter and $1.89 in the same quarter last year. The EPS (Diluted) for Q2 2024 stood at $0.98, compared to $1.42 in the prior quarter. Revenue per share for the quarter was $45.128, showing a slight increase from Q1 2024’s $42.504 but a decrease from $46.136 in Q2 2023. Over the last five years, ADM has achieved a compound annual growth rate (CAGR) of 20.30% in annual EPS without NRI, while the 10-year CAGR stands at 12%.

ADM’s gross margin for the quarter was 7.44%, which is above its 5-year median of 7.02%but still below the 10-year high of 8%. The company’s share buyback ratio over the last year was 10.8%, indicating that 10.8% of its total shares were repurchased, significantly higher than its 5-year buyback ratio of 1.40%. This aggressive buyback strategy likely contributed to supporting the EPS by reducing the number of outstanding shares.

Looking ahead, analysts estimate ADM’s EPS to reach $5.2 for FY1 ending in 2024 and $5.3 for FY2. Revenue projections suggest a growth trajectory with estimates of $87.7 billion in 2024, rising to $91.9 billion in 2026. The agricultural industry is expected to grow modestly over the next decade. ADM’s next earnings release is anticipated on October 25, 2024, which will provide further insights into financial performance and ADM stock outlook.

Evaluating ADM’s Financial Performance and Value Creation

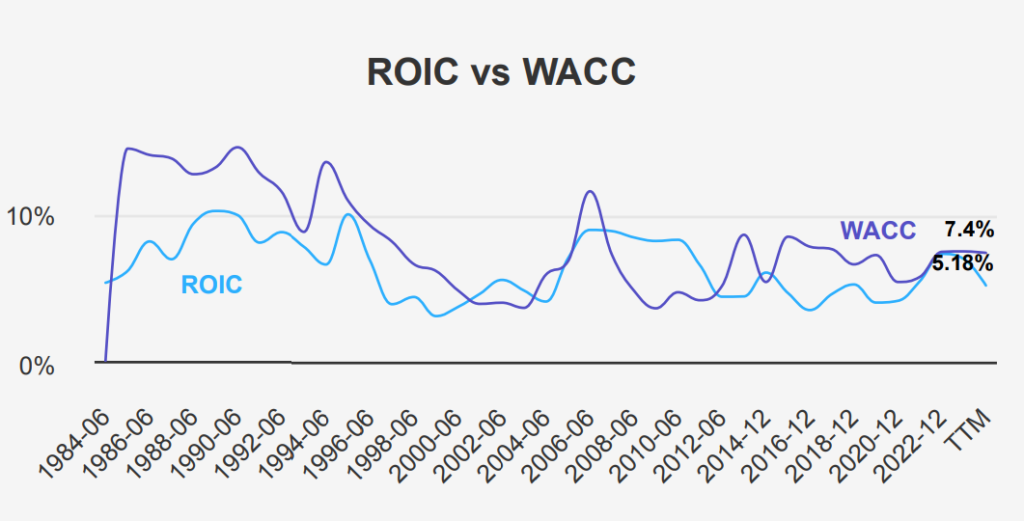

Under ADM stock outlook, ADM’s financial performance and capital allocation indicate a nuanced picture of economic value creation. The company’s Return on Invested Capital (ROIC) over the past five years has a median of 5.48%, which falls short of its median Weighted Average Cost of Capital (WACC) of 7.25%. This disparity suggests that ADM is not generating sufficient returns to cover its cost of capital, leading to a destruction of economic value.

In the current year, ADM’s ROIC is 5.18%, while the WACC is slightly higher at 7.40%. This reinforces the trend that the company is unable to generate returns that exceed its capital costs, further reflecting inefficiency in capital allocation. Over the last decade, the company’s highest ROIC was 7.33%, still only marginally above the lowest recorded WACC of 5.42%, which implies that even at its best, ADM’s capacity to create economic value has been constrained.

Overall, ADM’s financial metrics highlight challenges in creating shareholder value, as its cost of capital consistently surpasses its returns on invested capital.

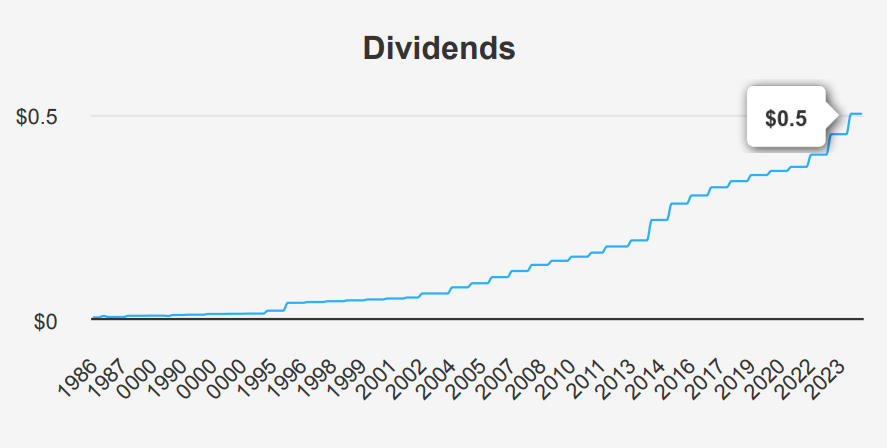

ADM Dividend Growth: Strong Trends and Future Outlook

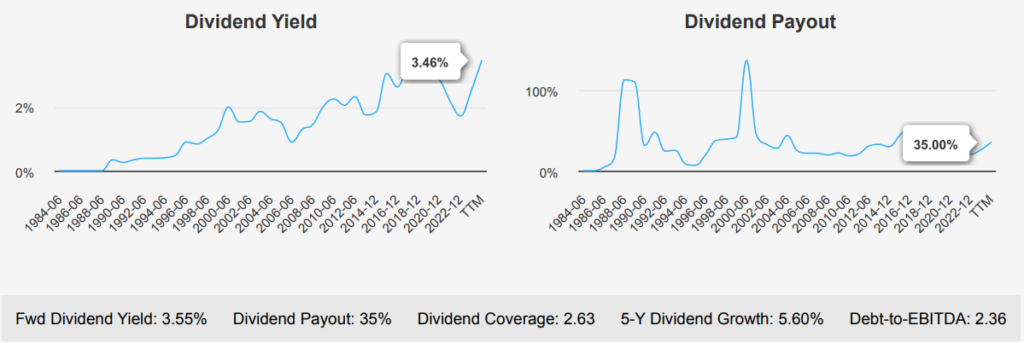

ADM has demonstrated consistent dividend growth, with a 3-year dividend growth rate of 7.70% and a 5-year rate of 5.60%. This growth is supported by a manageable dividend payout ratio of 35%, significantly below its historical highs, indicating a capacity for continued dividend increases. The company’s forward dividend yield stands at 3.55%, which is competitive within its sector.

The company’s debt-to-EBITDA ratio stands at 2.36, within the moderate range. This suggests ADM has manageable financial leverage, though it is prudent to remain cautious given industry-specific risks. The dividend payout ratio is currently 35.0%, significantly lower than historical highs, indicating ample room for future dividend increases and financial stability.

The forecasted 3-5 year dividend growth rate is 5.58%, aligning closely with past growth trends. If today is past August 21, 2024, the next ex-dividend date is expected around November 20, 2024, adjusted for weekends. This prediction is consistent with the quarterly dividend frequency and suggests continued reliable performance for dividend investors.

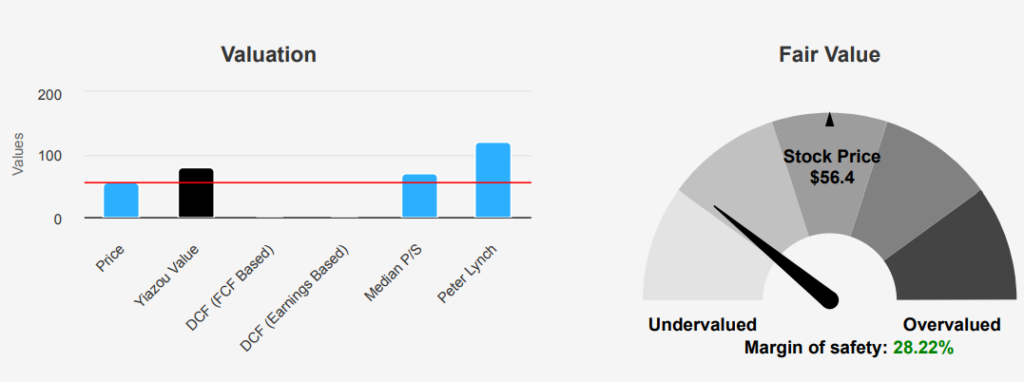

Valuation Analysis: Substantial Margin of Safety Identified

ADM’s intrinsic value is estimated at $78.57, significantly higher than its current market price of $56.40, providing a substantial margin of safety of 28.22%. The Forward Price-to-Earnings (P/E) ratio stands at 10.57, which is below its 10-year median of 14.39, indicating potential undervaluation relative to historical performance. The current P/E ratio TTM of 11.28 is also well below the 10-year high of 22.05, suggesting

that the stock may be trading at a discount compared to its historical peaks.

The company’s TTM EV/EBITDA ratio is 7.58, which is lower than the 10-year median of 9.89, further supporting the view that ADM holds undervaluation. This ratio is closer to the 10-year low of 6.02, indicating that the market might not fully appreciate ADM’s earnings potential. The TTM Price-to-Book (P/B) ratio is 1.22, below the 10-year median of 1.43, reinforcing the undervaluation narrative. These metrics suggest that ADM is trading below its historical valuations, offering investors a potential opportunity.

Analyst ratings and price targets show a slight downward adjustment in ADM stock outlook over the past few months, with the current price target at $61.70. Although there is a modest decrease in the target price, the current stock price still lies below this target, indicating potential for price appreciation. Overall, ADM appears to offer a compelling investment opportunity with a clear margin of safety and favorable valuation metrics compared to its historical averages, suggesting undervaluation relative to both its past and sector norms.

Evaluating Archer-Daniels Midland: Risks Versus Rewards

ADM stock outlook presents mixed signals in its risk assessment. A significant concern is the company’s increasing long-term debt, with $1.1 billion issued over the past three years, raising questions about its debt management strategy. Additionally, the company’s return on invested capital (ROIC) being less than its weighted average cost of capital (WACC) suggests potential inefficiencies in capital utilization. Insider activity is another red flag, with five insider selling transactions and no purchases in the last three months indicating possible concerns about future performance. The decline in revenue per share over the past 12 months further adds to these worries.

However, ADM also exhibits strengths that mitigate some risks. Its Beneish M-Score of -2.71 suggests a low probability of financial manipulation, which enhances its credibility. The expanding operating margin indicates improved profitability, and the price-to-book (PB) and price-to-sales (PS) ratios are close to three-year lows, implying an undervaluation. Moreover, ADM’s dividend yield is near a three-year high, which could attract income-focused investors. The strong Altman Z-score of 3.23 indicates financial stability, reducing the risk of bankruptcy. These positive factors could offset some of the risks associated with debt and insider selling.

Insider Selling Trends: Quantitative Analysis of ADM

The insider trading activity for ADM over the past year indicates a notable trend of selling, with no insider purchases recorded in the last 3, 6, or 12 months. Specifically, there have been 5 insider sales in the past three months and 6 sales over both the six and twelve-month periods. This consistent pattern of sales without corresponding purchases may suggest a lack of confidence among company insiders about the future performance of the company, or it could merely reflect personal financial considerations.

Insider ownership stands at a modest 2.97%, indicating a relatively low stake from the company’s directors and management, which could limit their influence on corporate governance compared to other stakeholders. Meanwhile, institutional ownership is quite high at 79.87%, suggesting that institutional investors have a significant interest and potentially more influence over company decisions. This high level of institutional ownership might convey a sense of stability and confidence from larger, more sophisticated investors despite the insider selling activities.

Liquidity Analysis: Daily Volume Trends and Dark Pool Impact

Under the ADM stock outlook, the stock’s liquidity profile reveals a significant level of trading activity. The daily volume of 4,305,089 shares indicates robust investor interest, surpassing the two-month average daily trading volume of 2,530,916 shares. This suggests heightened market activity and potentially increased liquidity for traders and investors interested in ADM.

The Dark Pool Index (DPI) stands at 61.72%, indicating that a substantial portion of trading activity occurs off-exchange in dark pools. This level of DPI suggests that over half of ADM’s trading volume is happening outside the traditional exchanges, which could impact price discovery and transparency. However, it also reflects the demand from institutional investors seeking to trade large blocks of shares without significantly affecting market prices.

Overall, ADM demonstrates strong liquidity, with volumes well above average, facilitating ease of entry and exit for traders. The high DPI also indicates a strong institutional interest, which can provide stability in trading prices but may lead to less visibility in price movements for retail investors. This liquidity and trading dynamic makes ADM an attractive option for both institutional and retail investors looking for active trading opportunities.

Representative Goldman’s Strategic ADM Trading Activity Revealed

Daniel Goldman, a Democratic Representative, recently executed two significant trades involving Archer Daniels Midland stock. On March 6, 2023, Goldman purchased shares valued in the range of $50,001 to $100,000 (transaction date: April 17, 2023).

Subsequently, on July 12, 2023, he sold shares of ADM, again in the range of $50,001 to $100,000, which was on reports on August 13, 2023. These trades suggest a short-term investment strategy, potentially aiming to capitalize on market fluctuations of ADM stock over a few months. The purchase and subsequent sale might indicate either a need to rebalance his portfolio or an attempt to lock in profits from an appreciation in ADM’s stock value. As both transactions occurred within a relatively short time frame, it highlights the fluid nature of Goldman’s investment approach.

Disclosures:

On the date of publication, Yiannis Zourmpanos did not hold (either directly or indirectly) any positions in the securities mentioned in this article. This report has been generated by our stock research platform, Yiazou IQ, and is for educational purposes only. It does not constitute financial advice or recommendations.