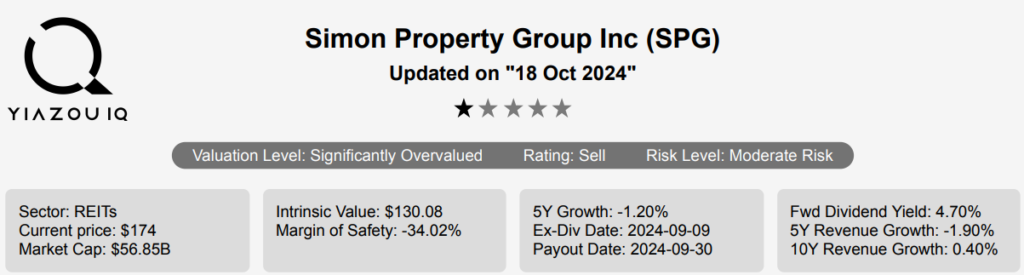

Simon Property Group: A Retail Real Estate Powerhouse

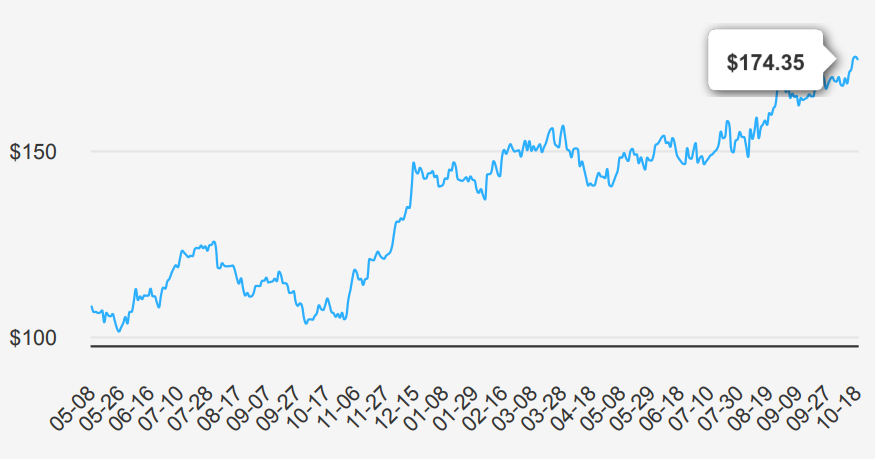

Simon Property Group stock represents the second-largest real estate investment trust in the United States. Its portfolio includes an interest in 230 properties: 136 traditional malls, 69 premium outlets, 14 Mills centers (a combination of a traditional mall, outlet center, and bigbox retailers), 6 lifestyle centers, and 5 other retail properties. Simon’s portfolio averaged $743 in sales per square foot in 2023 compared with $693 in sales per square foot over the 12 months before the pandemic. The company also owns a 22% interest in Klépierre, a European retail company with investments in shopping centers in 14 countries and joint-venture interests in 33 premium outlets across 11 countries. Simon Property Group stock is currently trading at ~$174.

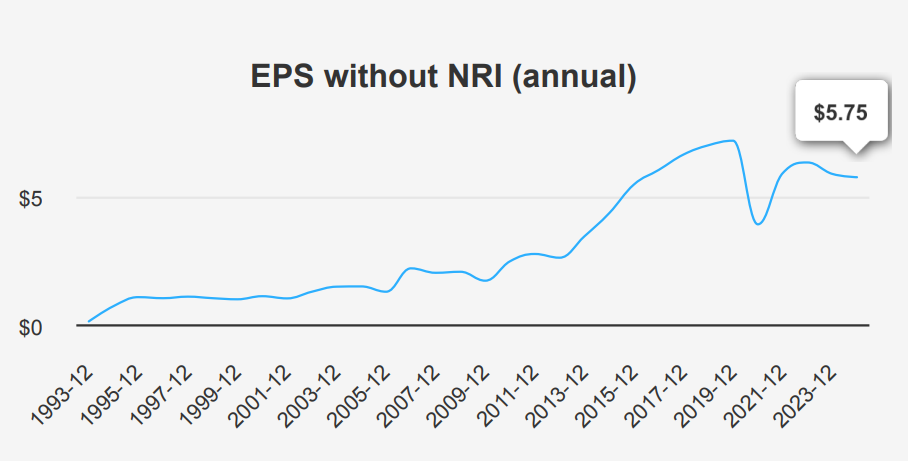

Strong EPS Growth Signals Resilience Amid Challenges

In the latest quarter ending June 30, 2024, Simon Property Group (SPG) reported an EPS without non-recurring items (EPS without NRI) of $1.512, marking a QoQ increase from $1.035 in the previous quarter and a YoY increase from $1.377 in the same period last year. Revenue per share slightly increased to $4.473 from $4.426 QoQ and $4.186 YoY. The 5-year CAGR for annual EPS without NRI stands at -2.40%, while the 10-year CAGR is at 3.40%. Industry forecasts suggest that the real estate investment trust (REIT) sector, in which SPG operates, is expected to grow by approximately 5% annually over the next decade.

SPG maintains a strong gross margin at 82.55%, which is the highest in the past decade, compared to the 5-year median of 81.08% and a 10-year median of 81.86%. The company has actively engaged in share buybacks, with a 1-year buyback ratio of 0.40%, indicating a repurchase of 0.40% of its shares over the past year. This strategy has likely supported the increase in EPS by reducing the number of outstanding shares, thereby enhancing shareholder value. Over a 5-year period, the buyback ratio is negative at -1.30%, reflecting a net issuance of shares.

Looking ahead, analysts estimate SPG’s EPS to be $7.116 for the next fiscal year ending December 2024 and $6.412 for the following year. Revenue projections for the next three years are $5,337.07 million, $5,492.05 million, and $5,711.87 million, respectively. The next earnings announcement is scheduled for November 5, 2024, providing further insight into SPG’s financial trajectory and market positioning.

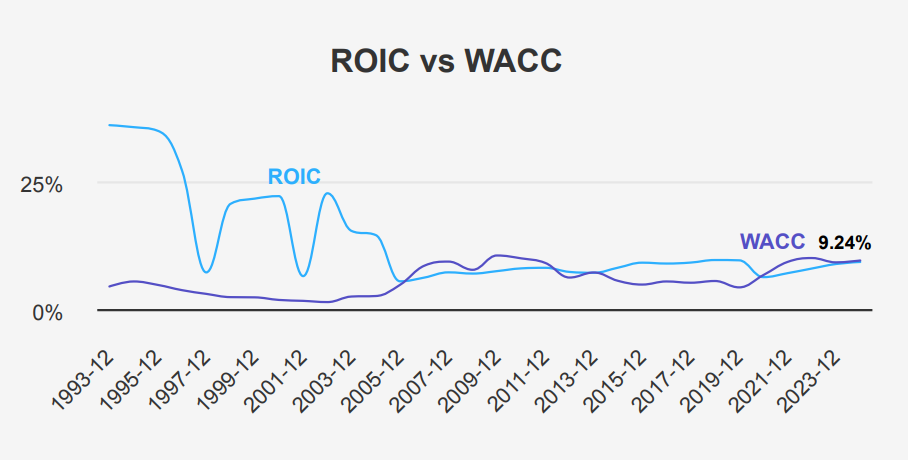

SPG Stock: Balancing ROIC and WACC Insights

Simon Property Group demonstrates a mixed performance in terms of economic value creation when comparing its Return on Invested Capital (ROIC) with its Weighted Average Cost of Capital (WACC). Over the past five years, SPG’s median ROIC is 7.95%, below the five-year median WACC of 9.16%, indicating that during this period, the company may not have consistently generated positive economic value.

However, based on the most recent figures, SPG’s ROIC is 9.24%, which is slightly below its current WACC of 9.96%. This suggests a marginal improvement in capital efficiency, but it still falls short of effectively covering its cost of capital. The high variability in WACC and ROIC over the decade, with a WACC range from 4.25% to 10.01%, further complicates consistent value creation.

Overall, while Simon Property Group stock is attached with a high return on equity (ROE) performance, its ability to generate economic value is challenged by a higher cost of capital, suggesting potential areas for strategic improvement in capital allocation and investment efficiency.

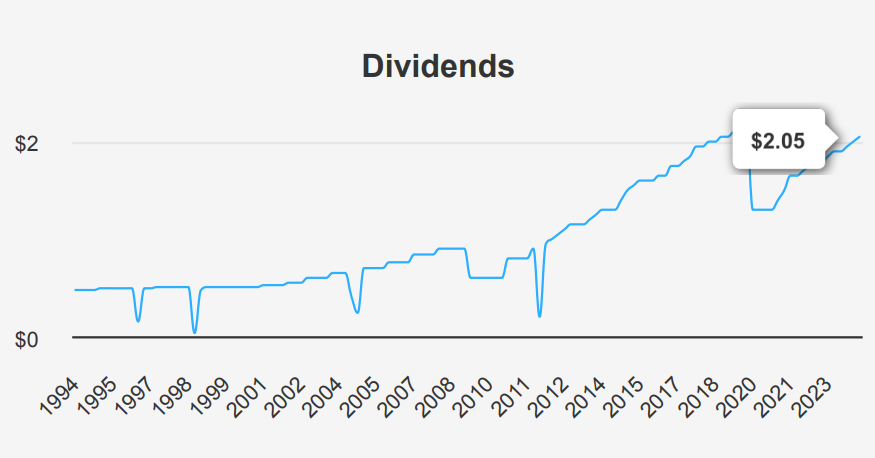

Simon Property Group Stock’s Dividend Dynamics

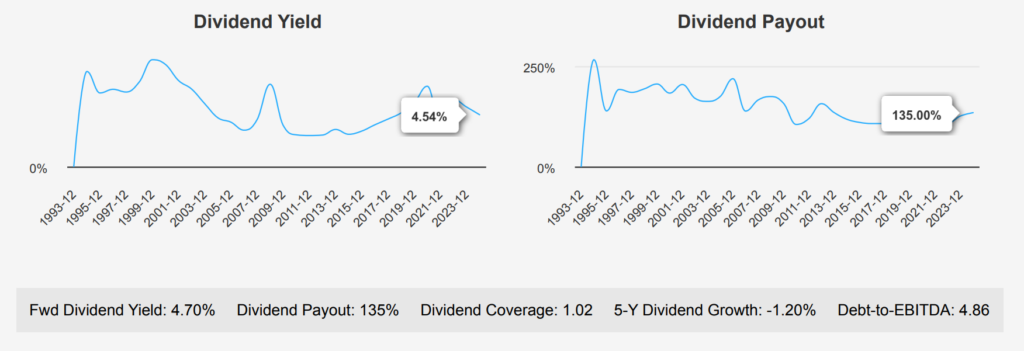

Simon Property Group demonstrates a robust dividend performance with a recent increase to $2.05 per share, reflecting a strong 3-year growth rate of 16.60%. Despite a 5-year decline of -1.20%, the forward dividend yield stands at an attractive 4.70%, aligning closely with its 10-year median of 4.61%. However, the dividend payout ratio at 135.0% significantly exceeds historical norms, indicating potential sustainability issues.

The Debt-to-EBITDA ratio of 4.86 suggests heightened financial risk, surpassing industry caution levels, which could impact future dividend stability. Simon Property Group stock’s dividend growth rate may be near 4.61% for the next 3-5 years, indicating moderate optimism despite current payout challenges.

SPG’s yield is competitive in sector comparison, but its high payout ratio and debt level warrant scrutiny. These financial leverage concerns might temper the forecasted dividend growth, albeit positively.

Given the quarterly frequency and ensuring it falls on a weekday, the next ex-dividend date is projected for December 6, 2024. This projection assumes the last ex-dividend date was September 9, 2024. Investors should monitor financial stability and sector trends closely.

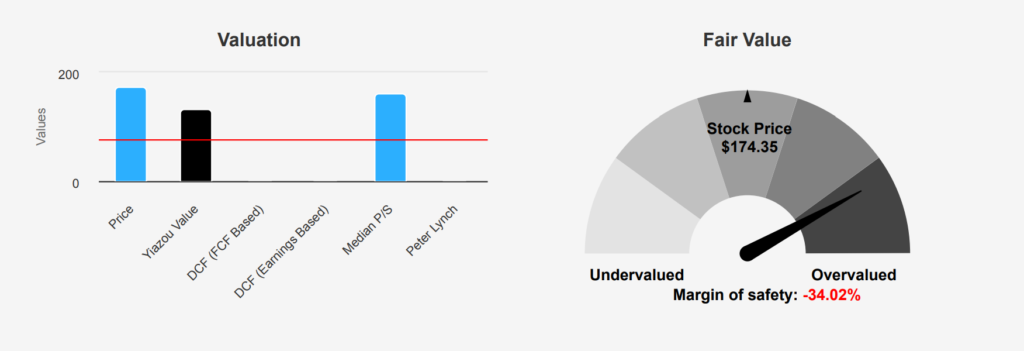

Assessing Simon Property Group Stock’s Valuation Metrics

Simon Property Group stock currently trades at $174.35, which significantly exceeds its intrinsic value of $130.08, indicating a negative margin of safety of -34.03%. This suggests the stock might be overvalued relative to its calculated intrinsic worth. The company’s TTM P/E ratio stands at 22.15, below its 10-year median of 23.47 but still within a range that historically has seen highs of 44.94 and lows of 7.07. The forward P/E ratio is slightly higher at 27.26, pointing towards expectations of earnings growth, though potentially overvalued compared to its historical medians

Examining other valuation metrics, the TTM EV/EBITDA ratio of 15.15 is slightly below its 10-year median of 15.97, suggesting a valuation that is relatively in line with its historical average. However, the TTM Price-to-Book ratio at 19.57 is near its historical high of 19.65, indicating potential overvaluation on this basis. The TTM Price-to-Free-Cash-Flow is 18.64 and is above its 10-year median of 17.11. It suggests a premium is being paid for the company’s cash flow generation.

Analyst ratings reflect a cautious outlook, with a current price target of $168.87 that has seen a slight upward adjustment from $159.60 three months ago. This gradual increase suggests a tempered optimism among analysts, though still below the current market price. Overall, SPG’s valuation metrics highlight potential overvaluation relative to its historical norms, particularly in terms of price-to-book and cash flow measures, which may caution investors against expecting significant upside without growth in fundamentals.

Navigating the Risk-Reward Landscape of SPG Investments

Simon Property Group Inc (SPG) presents a mixed risk profile. On the downside, the company’s financial indicators raise concerns about sustainability and financial health. The dividend payout ratio at 1.35 is quite high, suggesting potential sustainability issues with its dividends. Additionally, the Altman Z-score of 1.46 falls into the distress zone, indicating a risk of financial distress or potential bankruptcy within the next two years. The price-to-book ratio at 19.65 and price-to-sales ratio at 9.78 both suggest that the stock price is near its historical highs, which could imply overvaluation. The declining revenue per share over the last five years and the forward PE ratio surpassing the trailing PE ratio highlight a trend of declining earnings.

However, there is also positive news. The Piotroski F-Score of 9 suggests robust financial health, potentially offsetting some of the concerns raised by the Z-score. Furthermore, insider buying activity over the past three months, with 11 transactions totaling 2,365 shares, indicates confidence in the company’s future from those closest to it. The Beneish M-Score of -2.76 suggests that the company is unlikely to manipulate earnings, adding a layer of reliability to the financial disclosures.

While SPG has significant red flags, especially concerning its financial health and valuation metrics, the positive insider activity and strong F-score suggest a nuanced risk profile. Investors should weigh these factors carefully against their risk tolerance and investment strategy.

Insider Confidence: A Bullish Trend for SPG

The insider trading activity for SPG over the past year shows a positive trend with consistent insider buying and no insider selling. Over the last 3 months, there have been 11 insider purchases, while the last 6 months recorded 22 buys, and the 12-month data reveals 37 purchases. This consistent buying activity suggests confidence among company directors and management in the future prospects of SPG

The absence of insider selling further reinforces this positive sentiment, indicating that insiders are holding onto their investments rather than cashing out. Insider ownership stands at 0.84%, which, while relatively modest, may reflect a commitment to aligning interests with shareholders.

Institutional ownership is high at 88.63%, suggesting strong confidence from large investment entities in SPG. This substantial institutional backing, combined with the insider buying trend, paints a picture of a company with stable or potentially improving prospects. Overall, insider trading patterns positively indicate the company’s outlook.

Analyzing SPG’s Liquidity and Trading Dynamics Today

Analyzing the liquidity and trading activity for Simon Property Group (SPG), the current daily trading volume is 1,048,533 shares, below its two-month average daily volume of 1,449,745. This indicates a decrease in trading activity, possibly suggesting lower investor interest or market sentiment in the short term.

The Dark Pool Index (DPI) for SPG stands at 26.14%, hinting at the proportion of trading volume occurring in non-public exchanges or “dark pools.” A DPI of 26.14% suggests a moderate level of institutional trading activity, which can sometimes imply that institutions are either accumulating or distributing shares discreetly.

Overall, SPG’s current trading volume being below its average might lead to higher price volatility due to lower liquidity. Investors should be cautious, as lower liquidity can affect the ability to execute large trades without significantly impacting the share price. Monitoring changes in trading volume and DPI can provide additional insights into market sentiment and potential price movements.

Strategic Moves: Congresswoman Spartz’s Real Estate Bets

The recent financial activities of members of Congress, particularly in real estate investment trusts like Simon Property Group (SPG), highlight an interesting trend. On August 26, 2024, Representative Jonathan Jackson (D) from the House of Representatives made a purchase ranging between $15,001 and $50,000 of SPG. This transaction was on report on September 20, 2024, and could suggest confidence in the retail real estate sector, which SPG represents.

Earlier, on June 28, 2024, Representative Victoria Spartz (R) executed a larger purchase of SPG shares, valued between $50,001 and $100,000. This transaction was reported on July 25, 2024. Both transactions demonstrate a strong interest in SPG, potentially indicating favorable market trends or company performance expectations.

These investments could be reflective of strategic positioning in response to market conditions or anticipated legislative impacts on the commercial real estate sector. Other representatives monitoring further trades in this sector could provide additional insights.

Disclosures:

On the date of publication, Yiannis Zourmpanos did not hold (either directly or indirectly) any positions in the securities mentioned in this article. This report has been generated by our stock research platform, Yiazou IQ, and is for educational purposes only. It does not constitute financial advice or recommendations.