JPMorgan Stock: Investment In A Financial Titan

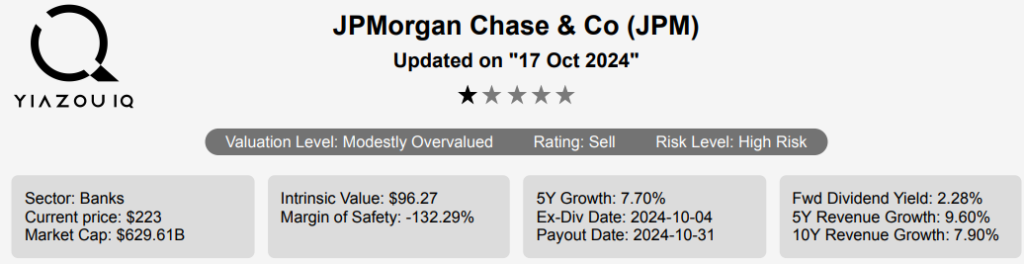

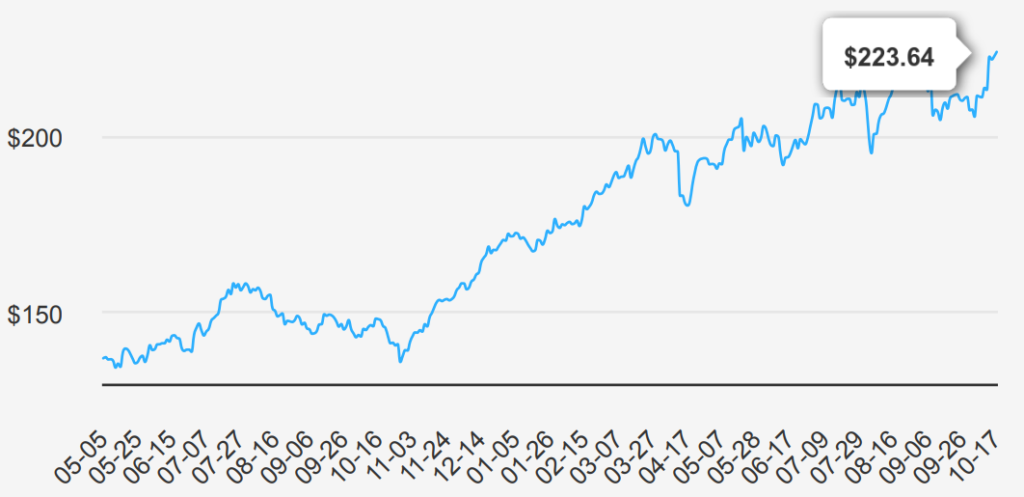

JPMorgan Chase (JPM) is one of the largest and most complex financial institutions in the United States, with nearly $4.1 trillion in assets. It is organized into four major segments: consumer and community banking, corporate and investment banking, commercial banking, and asset and wealth management. JPMorgan operates and is subject to regulation in multiple countries. JPM stock is currently trading ~$ at $223.

JPMorgan Stock Forecast Is Based Strong Earnings And Growth Potential

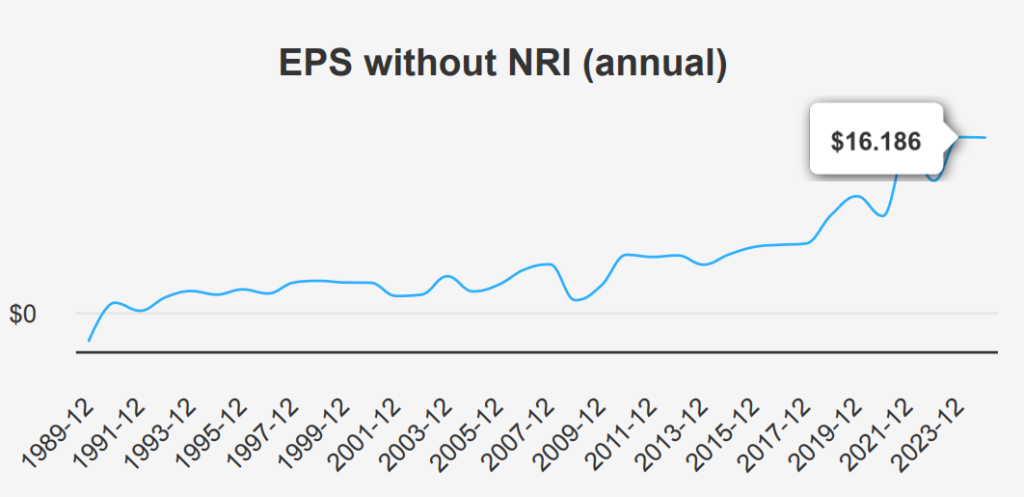

In the third quarter ending September 2024, JPMorgan reported an EPS without non-recurring items (NRI) of $4.439, marking an increase from $4.093 in the previous quarter (Q2 2024) but a slight decrease from $4.508 in the same quarter last year (Q3 2023). The EPS (Diluted) stood at $4.37, a decline from $6.12 in Q2 2024. The revenue per share rose to $14.883 from $14.612 in Q2 2024, showing a consistent upward trend year-over-year (YoY) from $13.599 in Q3 2023. The company’s 5-year and 10-year Compound Annual Growth Rate (CAGR) for EPS without NRI are 11.70% and 13.60%, respectively, reflecting solid growth over the decade.

JPMorgan’s stock buyback ratio for the past year is 2.10%, contributing positively to EPS by reducing the share count. Over the past decade, the buyback ratio has averaged 3.00%, demonstrating a consistent strategy to enhance shareholder value through repurchases (effective capital allocation). This strategy aids in offsetting any dilution from stock issuance, effectively supporting EPS growth and JPM stock forecast. Looking ahead, analysts forecast a promising revenue trajectory, with estimates ranging from $169.37 billion in 2025 to $175.53 billion in 2026.

The estimated EPS for the next fiscal year is at $18.715, suggesting continued profitability. The next earnings release is on January 15, 2025. Industry forecasts predict an average growth rate of approximately 5% annually over the next decade, which aligns well with JPM’s historical growth patterns and positions it favorably for future expansion. Analysts maintain a positive outlook for the company’s growth and profitability, demonstrated by its robust financial performance and strategic initiatives.

JPMorgan Chase: Navigating Capital Efficiency Challenges

For the JPM stock forecast, JPMorgan’s financial performance and capital allocation are under evaluation through its Return on Equity (ROE) against its Weighted Average Cost of Capital (WACC). In this case, JPM’s WACC has a five-year median of 7.80%, with a current figure of 11.56%. Despite this, JPMorgan’s Return on Equity (ROE) is relatively strong, with a five-year median of 14.07% and a current ROE of 16.12%, indicating that while the company struggles with invested capital returns, it still delivers solid shareholder returns through equity.

JPMorgan Chase: A Dividend Growth Powerhouse

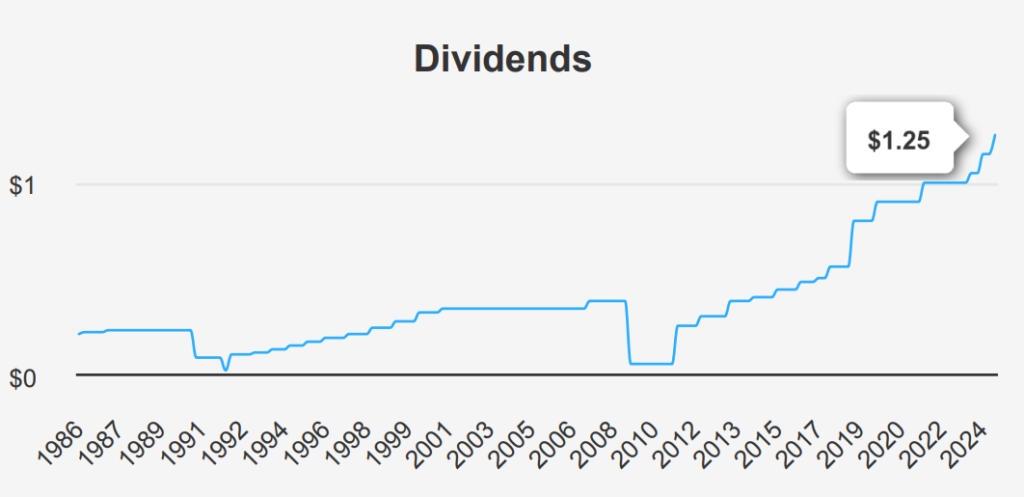

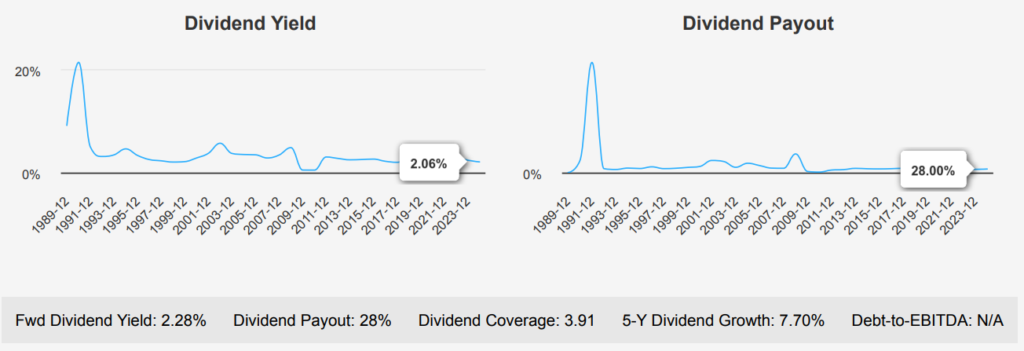

In the most recent quarter, JPMorgan Chase continued its dividend growth trend, raising its dividend per share from $1.15 to $1.25. Over the past five years, the company has achieved a dividend growth rate of 7.70%, with the three-year rate slightly lower at 4.40%. The forward dividend yield sits at 2.28%, close to its ten-year median of 2.58% but below the ten-year high of 4.16%. This suggests a stable but not exceptional yield relative to its historical performance.

The company’s dividend payout ratio is currently at a conservative 28%, significantly lower than its ten-year high and low, which hover around 100%, indicating a more sustainable payout level. This conservative payout strategy could support future dividend increases, aligning with the projected 3-5-year dividend growth estimate of 10.25%.

With the next ex-dividend date scheduled for October 4, 2024, and dividends paid quarterly, investors can expect the subsequent ex-dividend date to be around January 4, 2025, given the quarterly frequency, ensuring it falls on a weekday. The absence of a Debt-to-EBITDA ratio in the provided data limits a full assessment of financial leverage, but the low payout ratio suggests financial health. Overall, JPMorgan Chase’s dividend outlook appears positive and has a robust JPM stock forecast.

JPMorgan Stock’s Mixed Risk and Reward

JPMorgan stock presents a mixed risk profile with certain cautionary signals and strengths. The company’s PB ratio of 1.93 and PS ratio of 3.98 both hover near their decade highs, indicating potential overvaluation compared to historical standards. Additionally, the stock price nearing its 10-year high suggests that the current valuation may already reflect much of the market’s optimism, possibly limiting upside potential. Furthermore, the dividend yield close to a 5-year low might not be sufficiently attractive to income-focused investors, particularly if the stock is fully valued.

On the positive side, JPMorgan Chase exhibits financial robustness with a Beneish M-Score of -2.42, indicating a low likelihood of earnings manipulation. This adds a layer of trust to the financial integrity of the company. Moreover, the bank’s stable and predictable revenue and earnings growth support long-term investor confidence despite the recent increase in long-term debt issuance. While the debt level remains acceptable, continued monitoring may ensure it does not impair financial flexibility. Overall, while valuations suggest caution, JPMorgan’s solid operational performance and financial integrity provide assurance for JPM stock forecast.

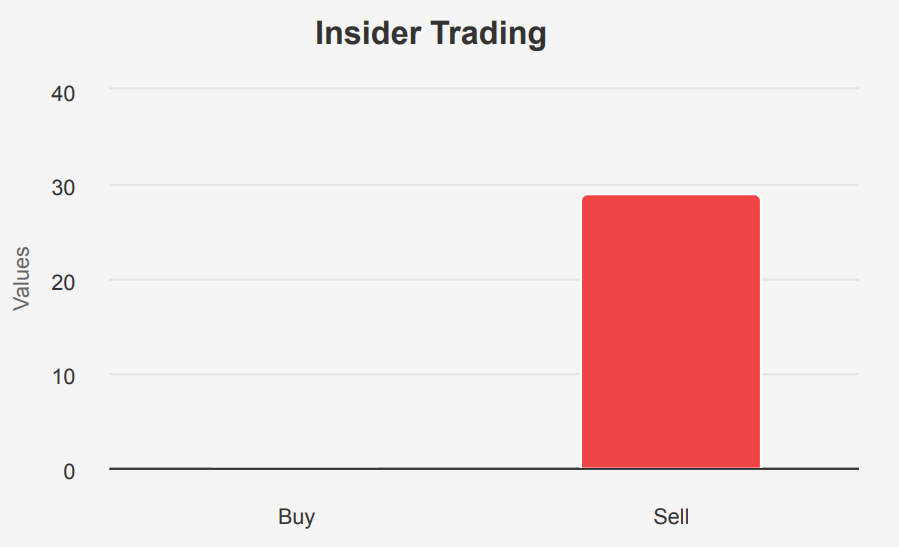

JPM Stock Insider Trading Trends: Selling Signals at JPMorgan

The insider trading activity for JPM stock over the past year reveals a consistent trend of selling by the company’s directors and management, with no recorded insider buying. Over the last 12 months, there have been 29 instances of insider selling, with 10 occurring in the past six months. This might indicate a lack of confidence among insiders regarding the company’s stock performance or a need for liquidity. The absence of insider purchases over the same period suggests that the insiders are not taking advantage of potentially low prices to increase their holdings, which can sometimes be a bullish signal.

Insider ownership is modest, at 0.69%, indicating that insiders hold a relatively small portion of the company’s shares. In contrast, institutional ownership is significantly higher, at 72.54%, suggesting that large institutional investors have a substantial stake in the company. This could mean that while insiders are selling, the company remains attractive to institutional investors, possibly due to its overall market position and financial health.

JPMorgan Stock: Liquidity and Market Activity

JPMorgan exhibits robust liquidity, as evidenced by its recent trading volumes. The average daily trading volume over the past two months stands at 8,835,137 shares, indicating a healthy level of investor interest and market activity. The most recent daily trading volume recorded is 6,329,928 shares, which, while slightly below the two-month average, still reflects strong liquidity.

The Dark Pool Index (DPI) for JPM stock is at 47.0%, suggesting that a significant portion of trades is occurring off-exchange in dark pools. This percentage points to a moderate level of trading being conducted away from public exchanges. It possibly indicates institutional investors’ involvement in the stock.

Overall, JPM’s liquidity appears solid, with its trading volumes supporting efficient entry and exit points for investors. The relatively high DPI might also imply that larger trades are being executed discreetly, possibly minimizing market impact. Under the JPM stock forecast, its liquidity profile is favorable for both active trading and longer-term investment horizons.

Divergent Trades: A Look at Congressional Moves

In recent trading activities by members of the US Congress, Representative Laurel Lee, a Republican serving in the House of Representatives, made a significant purchase. On September 10, 2024, she acquired shares of JPMorgan stock valued between $50,001 and $100,000. This transaction was reported on September 14, 2024. Her investment suggests confidence in JPChase’s prospects, particularly considering the substantial amount involved.

In contrast, Representative Marjorie Taylor Greene, a Republican in the House, participated in a smaller acquisition. On October 4, 2024, she purchased JPM stock shares worth between $1,001 and $15,000. This transaction is on record on October 8, 2024. While Greene’s investment is notably smaller, it still indicates interest in the financial sector, possibly reflecting broader market trends or personal investment strategy. Both transactions highlight a Republican interest in financial institutions in the current economic climate.

Disclosures:

On the date of publication, Yiannis Zourmpanos did not hold (either directly or indirectly) any positions in the securities mentioned in this article. This report has been generated by our stock research platform, Yiazou IQ, and is for educational purposes only. It does not constitute financial advice or recommendations.