EPR Properties Stock: A Dual-Focused Investment Strategy

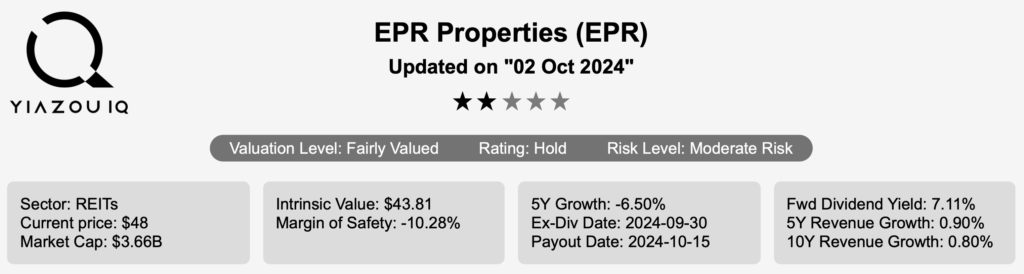

EPR Properties (EPR) is a real estate investment trust that leases experiential properties in the United States and Canada. The company invests in two property segments: Experiential, including theaters, family entertainment centers, ski resorts, and other attractions, and Education, including early childhood education centers and private school properties. New investments are determined based on the value and opportunity of the respective industry, location quality, and credit quality of tenants. The majority of revenue comes from the Experiential sector. The EPR stock is currently trading near ~$48. Let’s explore: Is EPR A Good Stock To Buy?

EPR’s Earnings: Growth Trends and Future Outlook

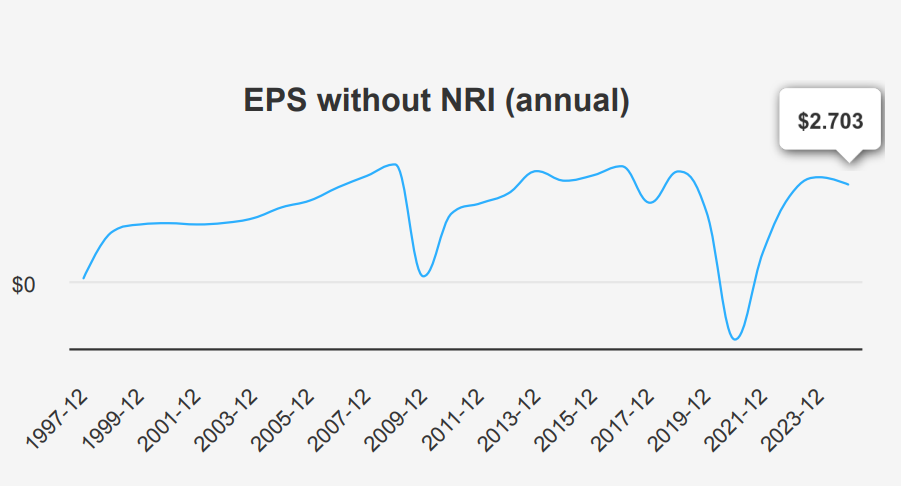

EPR reported an EPS without non-recurring items (NRI) of $0.647 for Q2 2024, showing a sequential increase from $0.538 in Q1 2024 but a decline compared to $0.679 in Q2 2023. The EPS (Diluted) for the latest quarter was $0.51, down from $0.75 in Q1 2024. This variation highlights the impact of non-recurring items on the company’s earnings. Revenue per share slightly increased to $2.087 from $2.05 in the previous quarter, although it was slightly lower than $2.15 in the year-ago quarter. Over a 5-year and 10- year period, EPR’s annual EPS without NRI has not shown significant growth, reflecting a stagnant trend in earnings performance.

EPR maintains a strong gross margin of 90.95%, slightly above its 5-year median of 90.30% but below the 10-year high of 95.35%. The 10-year share buyback ratio stands at -3.70%, meaning the company has reduced its outstanding shares by 3.70% over the decade, with a modest reduction of 0.50% in the past year. Share buybacks can enhance EPS by decreasing the number of shares outstanding, but the limited buybacks suggest a conservative approach in recent years. Analysts forecast industry growth to average around 3% annually over the next decade, indicating potential challenges for above-market growth.

Looking forward, analysts estimate EPS for FY1 2024 to reach $2.627, slightly increasing to $2.692 by FY2 2025, reflecting cautious optimism. EPR is scheduled to release its next earnings report on October 30, 2024. Analysts’ revenue estimates suggest a gradual increase to $645.14 million by 2025, with a slight dip to $643.25 million in 2026, suggesting stable but modest growth. The company appears focused on maintaining its margins, which is a positive mark to address ‘Is EPR A Good Stock To Buy?’.

Evaluating EPR: The Challenge of Economic Value Creation

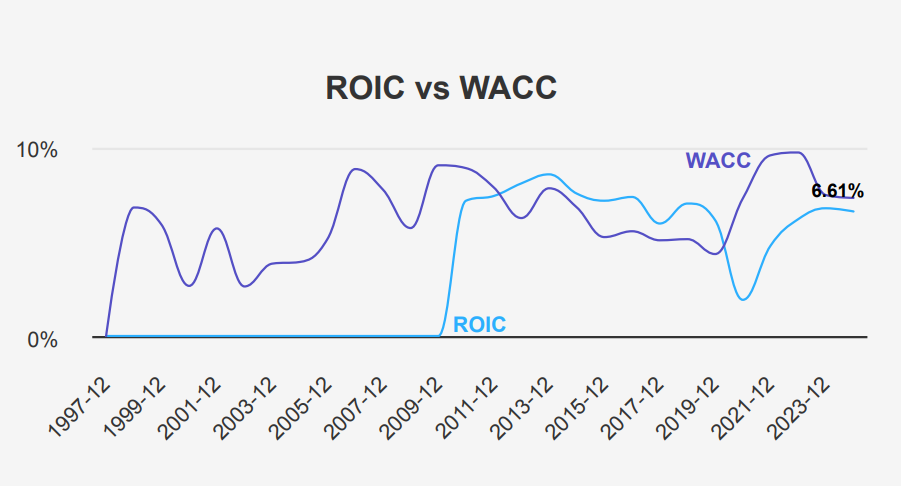

EPR’s economic value creation and financial efficiency can be assessed by comparing its Return on Invested Capital (ROIC) with its Weighted Average Cost of Capital (WACC). Over the past five years, EPR’s median ROIC stands at 6.15%, while its median WACC is 7.48%. This suggests that historically, EPR has not exceeded its cost of capital, indicating potential challenges in generating economic value.

However, more recent figures show a slight improvement, with a current ROIC of 6.61% compared to a WACC of 7.38%. Although this still shows a shortfall, the narrowing gap could suggest a trend towards more efficient capital use.

Despite these figures, EPR’s Return on Equity (ROE) has improved, currently at 8.53%, within a healthy range compared to its historical highs and lows. This indicates some level of shareholder value creation, albeit potentially insufficient to cover the capital costs entirely.

Overall, while EPR has shown some improvements, it still faces challenges in achieving an ROIC that consistently exceeds its WACC, which is necessary for sustainable economic value creation and justification of ‘Is EPR A Good Stock To Buy?’

EPR Properties: Dividend Challenges and Opportunities

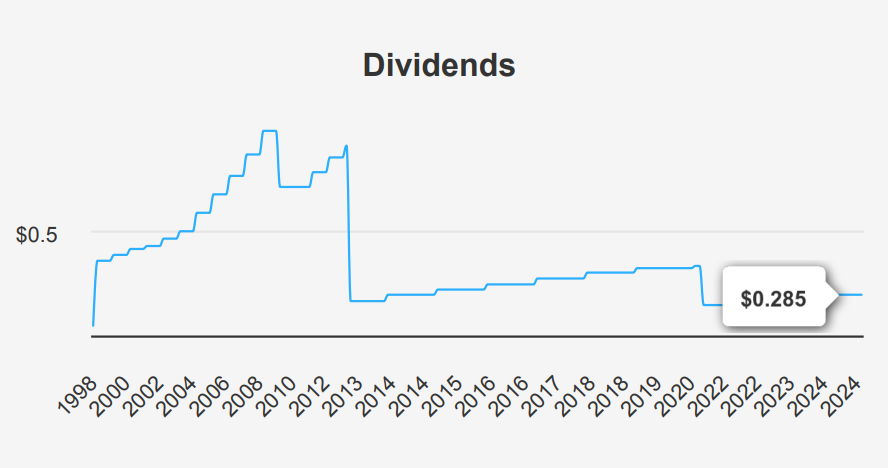

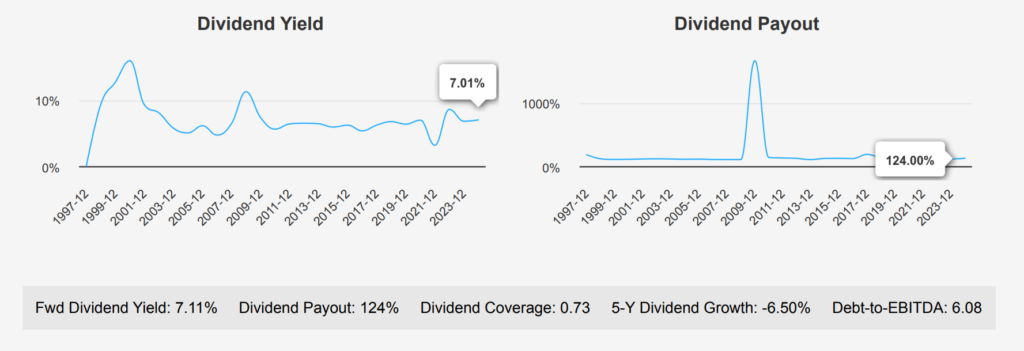

EPR has shown a mixed dividend performance recently. The company’s 3-year dividend growth rate is notably positive at 29.60%, which indicates robust growth over the short term. However, the 5-year dividend growth is negative at -6.50%, suggesting challenges in maintaining consistent growth over a longer period.

The current forward dividend yield is 7.11%, which is attractive compared to its 10-year median yield of 6.03%. However, the dividend payout ratio is concerning at 124.0%. This ratio, significantly higher than the 10-year median of around 101.33%, indicates that EPR is paying more in dividends than its net income, potentially unsustainable in the long term.

EPR’s debt-to-EBITDA ratio stands at 6.08. This is considered high and suggests increased financial risk, posing potential challenges in debt servicing. The forecasted 3-5 year dividend growth rate is modest at 2.25%, which might reflect efforts to stabilize payout levels amid financial constraints.

Given the dividend frequency of 12 (monthly), the next ex-dividend date following the latest recorded date of September 30, 2024, would likely be October 30, 2024, assuming it falls on a weekday.

EPR Stock Valuation: Balancing Intrinsic Worth and Market Price

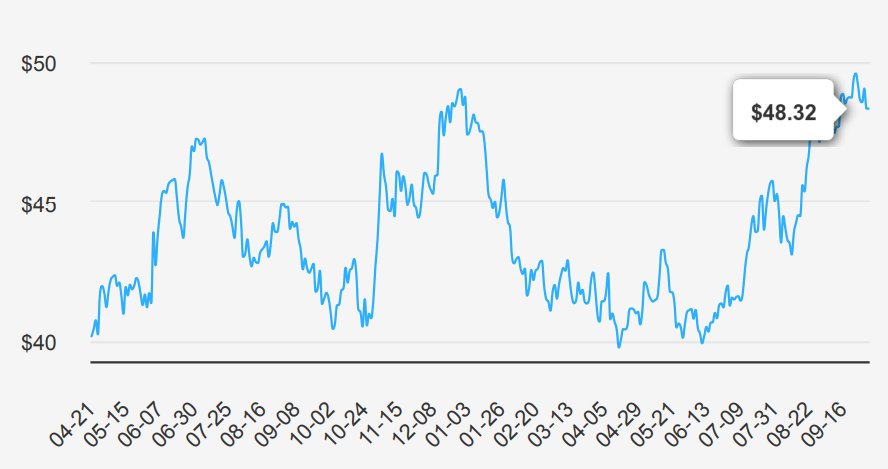

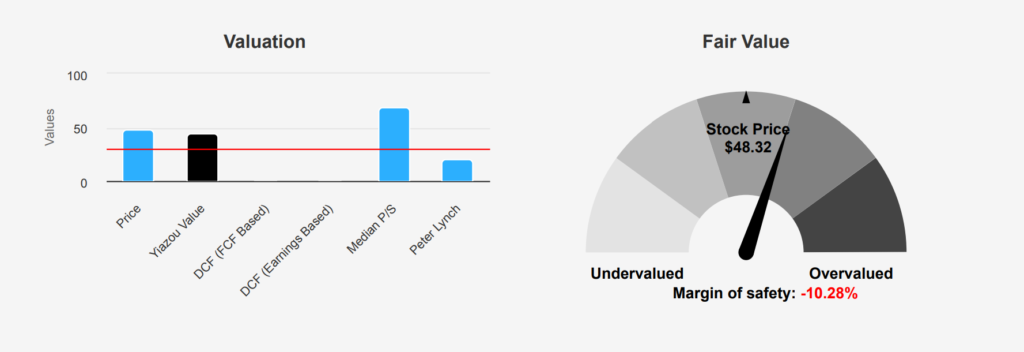

EPR’s current market price of $48.32 exceeds its intrinsic value of $43.81, indicating a negative margin of safety of -10.29%. This suggests that the stock may have overvaluation at present. The TTM P/E ratio is 19.8, slightly below the 10-year median of 21.52. This indicates it might be reasonably valued, although it is closer to the higher spectrum of its historical range. The forward P/E of 18.0 suggests a slight improvement in valuation expectations. The TTM P/S ratio stands at 5.62, which is lower than its 10-year median of 8.04, but still suggests a premium relative to its historical lows.

When examining EPR’s TTM EV/EBITDA of 13.44, it is below its 10-year median of 15.79 but comfortably above its lowest historical value, indicating a moderate valuation. The TTM Price-to-Book ratio is 1.51, which is slightly lower than the 10-year median of 1.57, suggesting that EPR is trading close to its book value. The Price-to-Free-Cash-Flow ratio of 9.09 is beneath the 10-year median of 11.68, indicating a relatively favorable cash flow valuation, though not at an extreme discount.

Analyst ratings point towards a stable outlook, with price targets remaining consistent over recent months, suggesting no significant shifts in market sentiment. Overall, EPR appears to have a fair valaution relative to historical norms, albeit slightly above its intrinsic value, which could imply limited upside potential unless growth prospects improve. Investors should consider these factors and monitor any changes in the broader economic conditions or company-specific developments that could impact future valuations and answer the question ‘Is EPR A Good Stock To Buy?’

EPR Properties: Risks and Rewards Unveiled

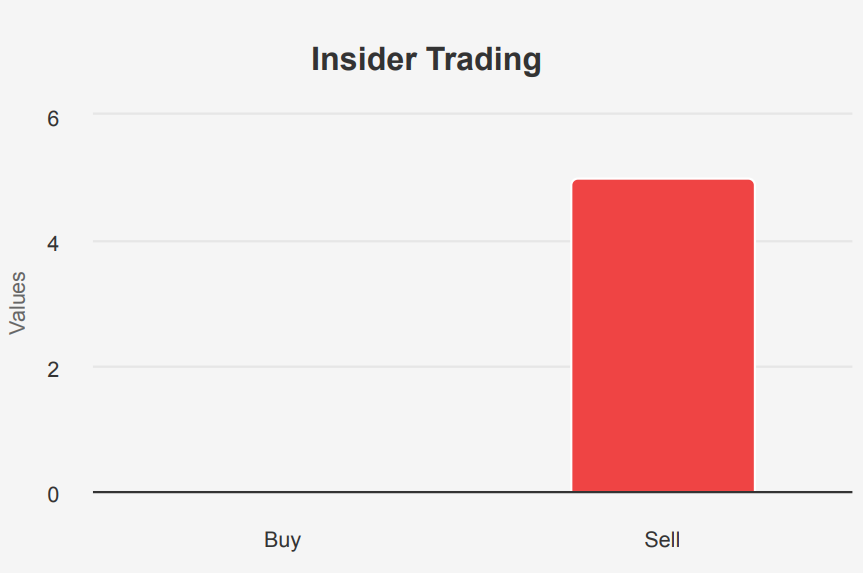

EPR Properties is currently exhibiting several financial risk indicators. The company’s insider transactions show a bias towards selling, with two sales and no purchases in the past three months, which can be a red flag for potential future performance. Additionally, the dividend payout ratio stands at an unsustainable level of 1.24, suggesting that current dividend payments may not be maintainable if earnings do not improve. The stock is also trading near its two-year highs in both price and price-to-sales ratio, which may indicate overvaluation.

EPR Properties’ ROIC is below its WACC, suggesting that it may not be generating sufficient returns on its investments. The Altman Z-score of 0.82 places the company in the distress zone, indicating a potential risk of bankruptcy within the next two years. Furthermore, the dividend yield is at a two-year low, which could deter income-focused investors.

On a positive note, under ‘Is EPR A Good Stock To Buy?’ EPR Properties’ operating margin is expanding, which is a good indicator of improving financial health and efficiency. Additionally, the Beneish M-Score suggests that the company is unlikely to be manipulating its financial statements, providing some reassurance regarding the integrity of its financial reporting.

EPR Stock Insider Selling Trends: Signals of Caution Ahead

The insider trading activity at EPR over the past year indicates a consistent selling pattern by company insiders, with no recorded purchases. In the last 12 months, there have been five instances of insider selling, with two of those occurring within the most recent three months. This suggests a possible lack of confidence or a strategic divestment by insiders. This selling activity could indicate insiders expecting limited upside potential or attempting to capitalize on the current market valuation.

Insider ownership is relatively low at 2.52%, which might imply limited influence over company decisions by those holding insider shares. Conversely, institutional ownership stands at a robust 70.15%. This highlights that institutional investors hold a significant portion of the company’s shares. This high level of institutional ownership could provide stability and influence the company’s strategic direction, potentially offsetting any concerns raised by insider selling. Overall, the trend points to a cautious outlook by insiders, warranting further investigation into management’s future expectations for EPR.

EPR’s Trading Dynamics: A Deep Dive into Liquidity

EPR’s trading activity shows a daily volume of 389,059, below its average daily trade volume of 556,260 over the last two months, indicating a recent decline in trading interest. This discrepancy may suggest that liquidity may get tight.

The Dark Pool Index (DPI) stands at 54%, suggesting that most trades might occur in off-exchange venues. A DPI above 50% could imply that institutional or large-scale investors might engage more in private trading activities, possibly minimizing market impact and indicating a strategic positioning or accumulation.

Regarding liquidity, the drop in trading volume might reflect potential investor caution or a shift in market sentiment. However, the significant DPI indicates that larger players might have underlying interests, which could eventually translate into higher market liquidity if these trades spill over into regular trading venues. This may form a positive element to address ‘Is EPR A Good Stock To Buy?’

Congressional Trading: Strategies Amid Market Fluctuations

On July 12, 2023, Representative Daniel Goldman, a Democrat in the House of Representatives, executed a sale of EPR Properties shares valued in the range of $1,001 to $15,000. This transaction was reported on August 13, 2023. Notably, this trade may reflect a strategic financial decision amidst market conditions at the time or possibly an adjustment in portfolio strategy, considering the real estate investment trust (REIT) sector’s sensitivity to interest rate changes and economic fluctuations.

In a separate transaction, Representative Zoe Lofgren, also a Democrat in the House, sold EPR shares with a similar value range on March 16, 2020. The report date for this transaction was April 11, 2020. This sale occurred during the early stages of the COVID-19 pandemic, a period marked by significant market volatility, which might have influenced the decision to liquidate the position to mitigate risk or reallocate assets.

Both trades reflect the representatives’ responses to differing market conditions, possibly aiming to optimize their investment portfolios in response to economic factors at those times.

Disclosures:

On the date of publication, Yiannis Zourmpanos did not hold (either directly or indirectly) any positions in the securities mentioned in this article. This report has been generated by our stock research platform, Yiazou IQ, and is for educational purposes only. It does not constitute financial advice or recommendations