PayPal Stock Represents A Leader In Transaction & Payment Processing Services

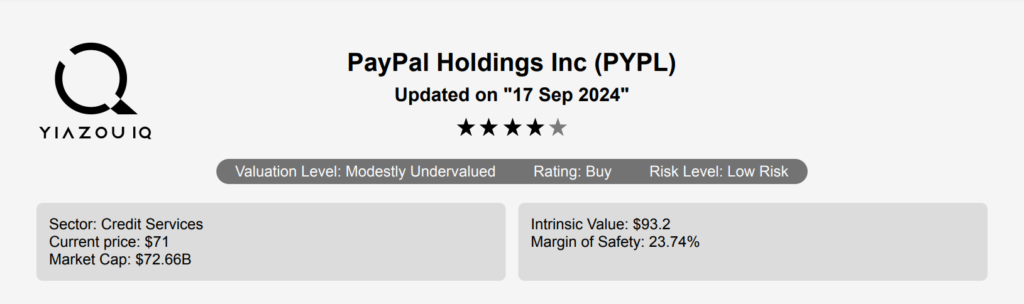

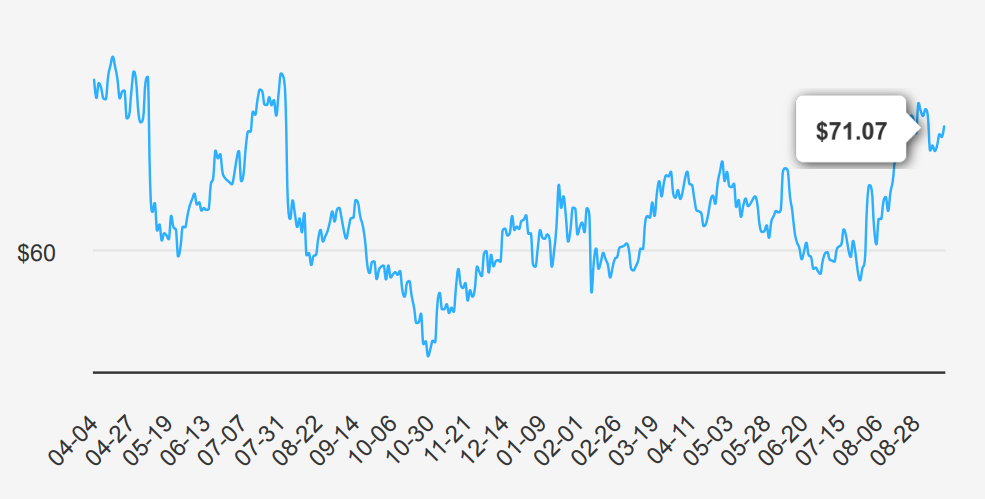

PayPal (PYPL) was spun off from eBay in 2015 and provides electronic payment solutions to merchants and consumers, focusing on online transactions. At the end of 2023, the company had 426 million active accounts. The company also owns Venmo, a to-person payment platform. PYPL stock currently trades at $71.

Earnings Surge: Growth, Margins, and Outlook

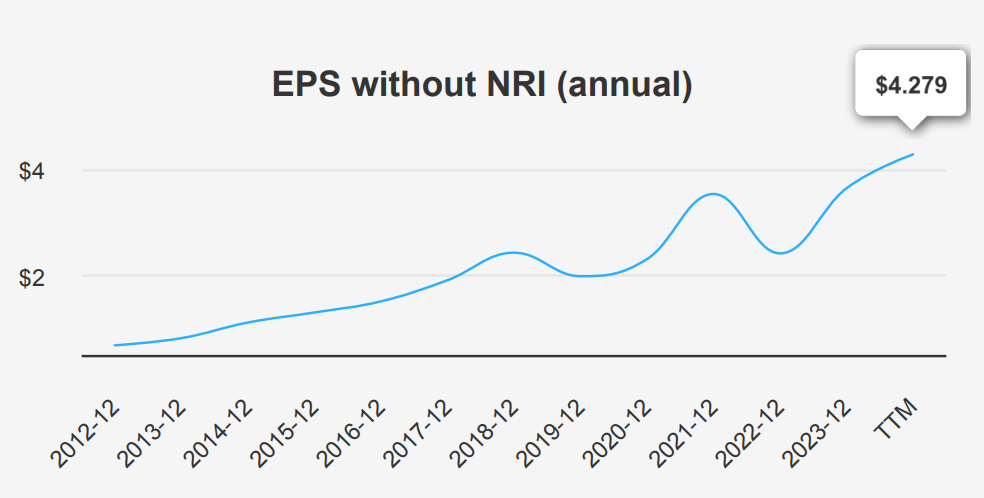

PayPal Holdings reported its earnings for the quarter ending June 30, 2024, with EPS without non-recurring items (NRI) at $1.19. This is up from $1.08 in the previous quarter and $0.843 in the same quarter last year. This represents a quarter-over-quarter (QoQ) increase of 10.19% and a year-over-year (YoY) growth of 41.19%. The company’s revenue per share also saw growth, reaching $7.531 from $7.182 in the previous quarter and $6.541 a year ago. Over the past five years, PayPal’s EPS without NRI has grown at a compound annual growth rate (CAGR) of 9.10%. Over the past ten years, the CAGR has been an impressive 14.20%

Regarding margins, PayPal’s gross margin has decreased to 45.48%, marking the lowest point in a decade. This is below its 5-year median of 54.03% and 10-year median of 55.40%. The company has been engaging in share buybacks, with a 1-year buyback ratio of 6.40%. This indicates that 6.40% of the outstanding shares have been repurchased within the last year. This aggressive buyback strategy has positively impacted EPS, as reducing the number of shares outstanding typically increases earnings per share, providing a buffer against shrinking margins.

Looking forward, analysts forecast PayPal’s revenue to grow steadily, with estimates of $31.9 billion by the end of 2024 and $37.07 billion by 2026. The industry is expected to expand at an annual rate of around 9% over the next decade, offering a supportive backdrop for PayPal’s growth. The next earnings release is anticipated on November 1, 2024, with estimated EPS for FY1 and FY2 at $3.935 and $4.628, respectively. This suggests a continued upward momentum for PayPal stock.

PayPal’s Strong Financial Efficiency and Value Creation

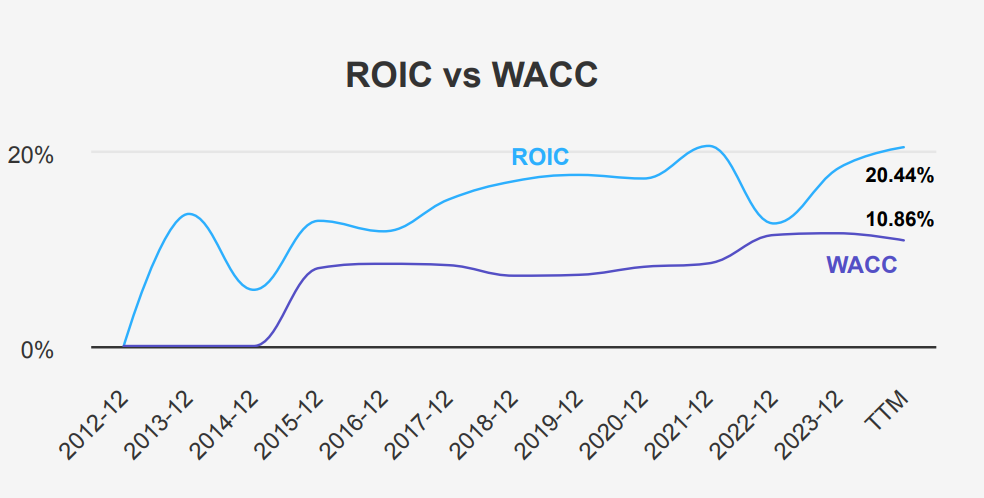

PayPal has demonstrated a solid ability to generate economic value. This is evidenced by its Return on Invested Capital (ROIC) consistently exceeding its Weighted Average Cost of Capital (WACC). Over a five-year median period, PYPL’s ROIC stands at 17.59%, significantly higher than its WACC of 8.50%. Currently, the ROIC is 20.44%, which surpasses the current WACC of 10.86%.

This positive spread indicates that PYPL is effectively generating returns that exceed the costs associated with its capital. This highlights its financial efficiency and capacity to create shareholder value. The robustness of PYPL’s financial performance is further supported by its Return on Equity (ROE), which has a five-year median of 19.97% and currently stands at 21.80%. These figures suggest that PYPL effectively leverages its equity base to generate profits.

Overall, PYPL’s ability to maintain an ROIC above its WACC suggests that it is a well-managed company capable of sustainable growth and value creation for its investors.

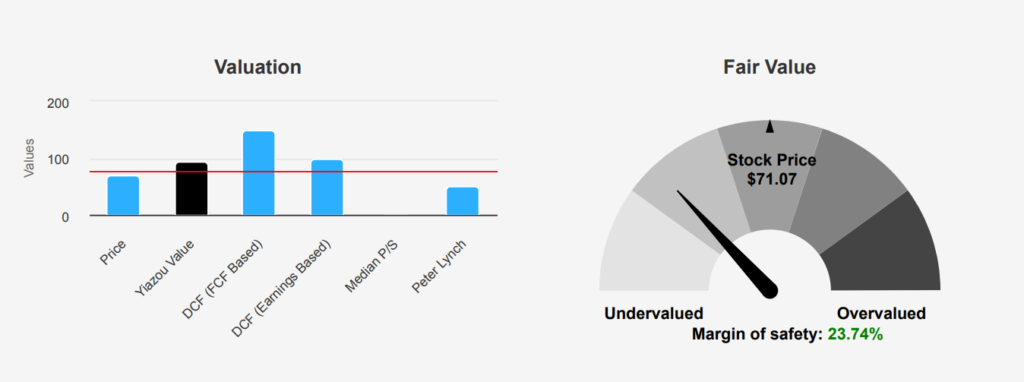

PayPal Stock’s Valuation: Undervalued with Strong Upside

PayPal presents a compelling valuation opportunity, with its intrinsic value estimated at $93.2. This is well above its current market price of $71.07, providing a substantial margin of safety of 23.74%. This indicates a potential undervaluation, suggesting the stock is trading below its true worth. The TTM P/E ratio stands at 17.21, relatively close to its 10-year low of 14.11 and significantly lower than the 10-year median of 46. This could imply that the stock is undervalued compared to historical norms.

PYPL’s TTM EV/EBITDA ratio of 9.62 is near its 10-year low of 8.10. This is well below the median of 26.1, reinforcing the notion of undervaluation. Similarly, the TTM Price-to-Free-Cash-Flow ratio of 11.37 is closer to its 10-year low of 9.35 than the median of 24.34. It indicates that the stock is attractively priced based on cash flow metrics. The TTM Price-to-Book ratio is also relatively low at 3.56 compared to its 10-year median of 5.36, further supporting the case for undervaluation.

When considering analyst perspectives, the growing price target from $76.54 two months ago to $79.65 currently suggests an improving outlook. With 46 analyst ratings and a positive trend in price targets, the sentiment around PYPL appears optimistic. Overall, the combination of PYPL’s intrinsic value exceeding the current market price and favorable valuation metrics compared to historical averages suggests a strong potential for price appreciation, making PYPL stock an attractive investment opportunity in today’s’ market.

Balancing Act: PayPal’s Financial Risks and Rewards

PayPal Holdings Inc.’s financial risk profile presents a mixed picture. The rising long-term debt, with USD 3.2 billion issued over three years, suggests a cautious approach to leverage but remains within acceptable limits. The declining gross margin, averaging a yearly decrease of 3.3%, raises concerns about operational efficiency and cost management strategies. Furthermore, the Altman Z-score of 1.88 places PayPal in the “grey area,” indicating potential financial stress and a need for vigilance, as further declines could signal a heightened bankruptcy risk.

Contrasting these concerns, PayPal benefits from a strong Piotroski F-Score of 7, reflecting robust financial health and operational efficiency. The Beneish M-Score of -2.55 is well below the threshold for manipulation risk, suggesting reliable financial reporting. Additionally, consistent and predictable revenue and earnings growth underscores PayPal’s’ capacity to generate shareholder value. Despite the stock price nearing a 1-year high, indicating positive market sentiment, investors should weigh the potential risks associated with its financial stress indicators and declining margins against its demonstrated operational strengths and growth prospects.

PYPL Insider Activity Signals: Confidence or Caution?

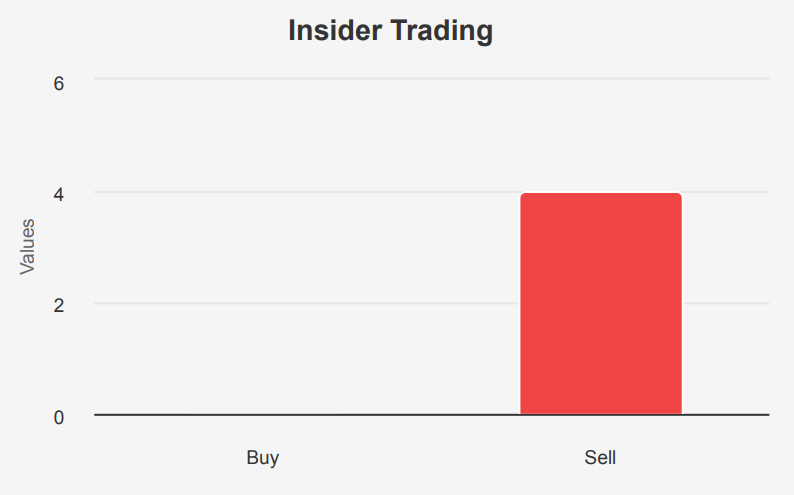

Analyzing insider trading activity for PayPal stock over the past year, there have been no insider purchases and four insider sales. Specifically, one sale occurred in the last six months, and three additional sales took place during the preceding six months. This trend indicates a lack of insider buying confidence, although the selling activity is relatively low and spread over the year.

Insider ownership stands at 7.10%, suggesting that directors and management hold a moderate portion of company shares. Institutional ownership is significantly higher at 69.62%, indicating solid institutional interest and confidence in the company’s’ prospects. The absence of recent insider buys could imply that insiders do not perceive the stock as undervalued at current market conditions. Meanwhile, the limited selling might suggest that insiders are not in a rush to divest, maintaining a certain level of confidence in the company’s long-term performance. Overall, the insider trading trend reflects cautious sentiment among company insiders.

Evaluating PayPal Stock’s Liquidity and Trading Trends

PayPal stock exhibits notable liquidity and trading volume activity. The average daily trading volume over the past two months is approximately 12,245,679 shares, which indicates a robust level of investor interest and active market participation. On the latest trading day, the volume was recorded at 6,207,965 shares, which is about 50.7% of the two-month average, suggesting lower-than-average trading activity on that specific day.

The Dark Pool Index (DPI) for PYPL stands at 49.81%, highlighting that nearly half of the trades occur away from public exchanges. This could potentially indicate significant institutional interest and possibly less transparency in the market regarding the stock’s trading dynamics. This level of DPI might suggest strategic movements by larger investors, which could impact price volatility and liquidity.

Overall, PYPL’s liquidity seems sufficiently supported by its average trading volumes, although variations in daily activity and the relatively high DPI may suggest the need for retail investors to pay attention to broader market trends and institutional behaviors when considering trades.

PYPL’s Patent Trends: Insights and Future Outlook

Over the past five years, PYPL has demonstrated a consistent commitment to innovation, as reflected in its patent filings. From 2019 to 2023, PYPL’s patent numbers have shown fluctuations, peaking in 2021 with 325 patents. Despite a slight decline in 2022 and 2023, the company maintained substantial numbers, indicating ongoing R&D efforts. The projected drop to 213 patents in 2024 could suggest a strategic shift or a temporary reduction in innovation activities. Overall, PYPL remains a key player in technological advancements.

Senator Tuberville’s Swift Moves with PayPal Stock

In May 2024, Senator Tommy Tuberville, a Republican from the Senate, executed significant trades involving PayPal. On April 30, 2024, Tuberville made a purchase in the $1,001 – $15,000 range, indicating a potential strategic interest in PYPL stock. However, a few days later, on May 3, 2024, he sold off his entire position in PYPL, with the transaction valued between $100,001 and $250,000. This rapid turnaround from purchase to full sale suggests reevaluating the stock’s potential or market conditions, prompting a swift exit.

Disclosures:

Yiannis Zourmpanos has a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. This report has been generated by our stock research platform, Yiazou IQ, and is for educational purposes only. It does not constitute financial advice or recommendations.