Enterprise Products Stock Is Attached With A Midstream Powerhouse

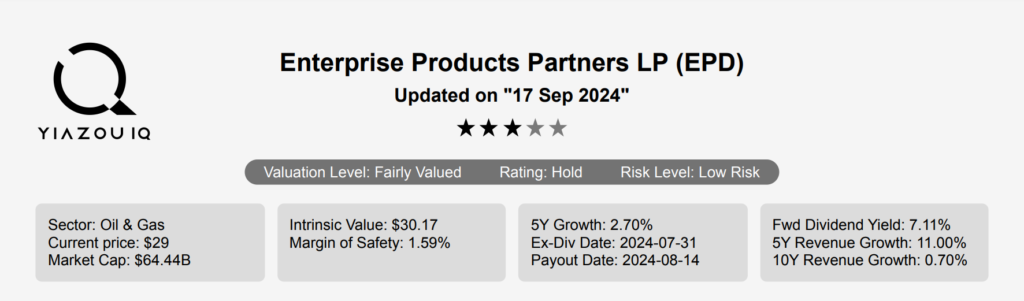

Enterprise Products Partners (EPD) is a master limited partnership. It transports and processes natural gas, natural gas liquids, crude oil, refined products, and petrochemicals. It is one of the largest midstream companies, with operations servicing most producing regions in the Lower 48 states. Enterprise is particularly dominant in the NGL market and is one of the few MLPs. The company provides midstream services across the full hydrocarbon value chain. The EPD stock is currently trading at ~$30.

Steady Growth with Margins Under Pressure at EPD

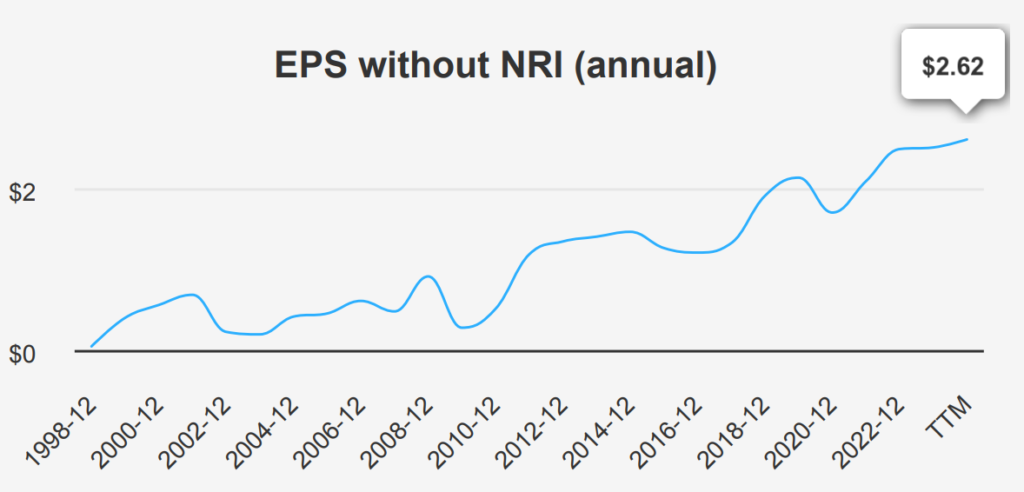

For the second quarter ending June 30, 2024, Enterprise Products Partners reported an EPS without NRI (which excludes non-recurring items) of $0.64. This is slightly down from $0.66 in the previous quarter and up from $0.57 in the same quarter last year. Revenue per share was $6.145, down from $6.731 in Q1 2024 but up significantly from $4.85 in Q2 2023, reflecting robust year-over-year growth. Over the past five years, EPD’s EPS has grown at a Compound Annual Growth Rate (CAGR) of 6%. Meanwhile, the ten-year CAGR stands at 7.30%. Industry forecasts suggest an average annual growth rate of around 5% over the next decade. It indicates a steady, albeit moderate, growth path for the sector.

EPD’s gross margin for the quarter was 12.77%. It is below its five-year median of 14.04% and significantly lower than its ten-year high of 17.75%. This suggests some margin compression, likely due to increased costs or competitive pricing pressures. The company’s share buyback ratio over the past year was 0.10%, indicating modest repurchase activity. This ratio means that 0.10% of EPD’s outstanding shares have been repurchased. This slightly enhances the EPS by reducing the share count. Over three and five years, the buyback ratio has been stable at 0.20%.

Looking ahead, analysts estimate EPD’s EPS to reach $2.725 for the next fiscal year and $2.870 for the year after. Revenue estimates project growth, with forecasts of $56,703.18 million for 2024 and increasing to $61,627.71 million by 2026. EPD’s next earnings announcement is expected on October 30, 2024. This will provide further insights into its financial performance and strategic initiatives, potentially influencing its future growth trajectory.

EPD’s Capital Efficiency: Sustaining Strong Returns Over Costs

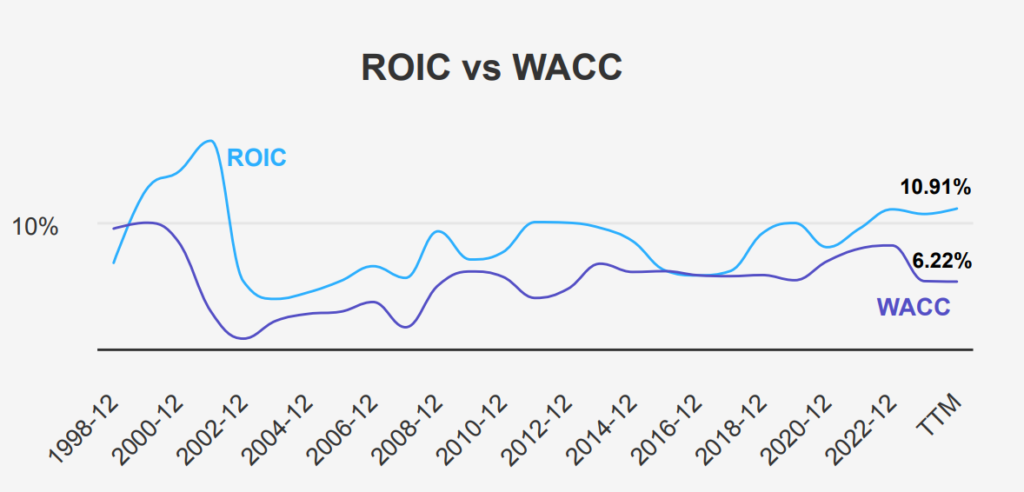

Enterprise Products Partners exhibits strong financial performance and value creation. It is primarily demonstrated by its return on invested capital (ROIC), which consistently exceeds its weighted average cost of capital (WACC). With a current ROIC of 10.91% against a WACC of 6.22%, EPD is effectively generating economic value as the returns on its investments surpass the overall cost of capital.

Over the past five years, EPD has maintained a median ROIC of 9.98%. This still outpaces its median WACC of 7.53%. This consistent performance indicates effective capital allocation and operational efficiency. Additionally, the firm’s Return on Equity (ROE) has been robust, with a median of 18.89%, rising to 20.92%, reflecting strong shareholder value creation.

By maintaining a ROIC consistently above the WACC over the long term. EPD not only underscores its ability to manage its capital efficiently but also reassures investors of its capacity to generate sustainable economic returns, thereby enhancing overall shareholder wealth.

EPD Stock: Steady Dividend Growth with Attractive Yield and Stability

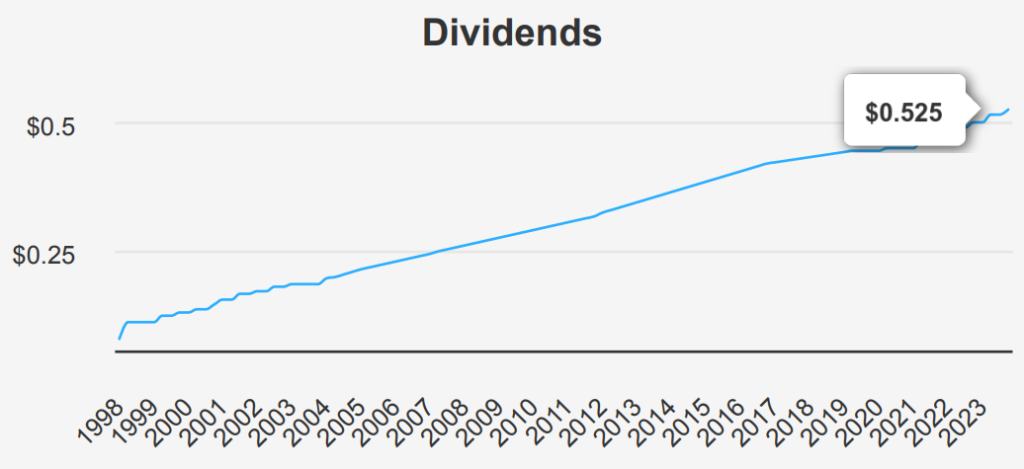

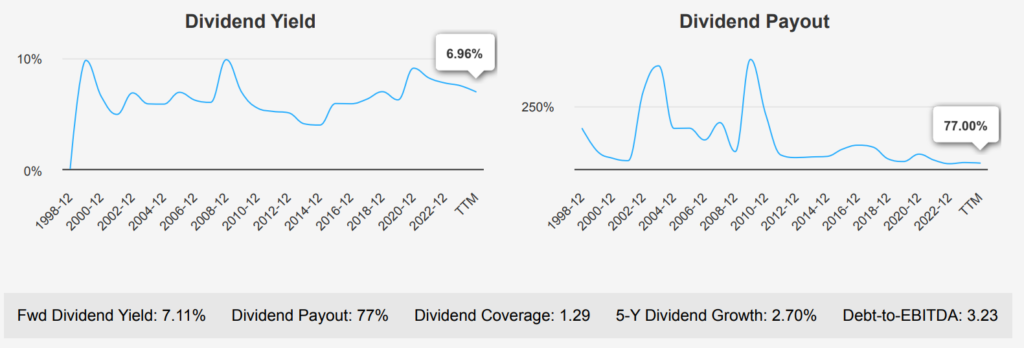

Enterprise Products stock has shown consistent dividend growth with a 5-year growth rate of 2.70% and a 3-year rate of 3.60%. In the most recent quarter, the dividend per share increased to $0.525 from $0.515, indicating a positive trend in shareholder returns. With a forward dividend yield of 7.11%, EPD offers an attractive yield compared to its 10-year median of 6.60%. Although it is still below the historical high of 12.59%.

EPD’s dividend payout ratio stands at 77%, significantly below its 10-year high and median values. This suggests improved earnings coverage for its dividend payments. The future 3-5 year dividend growth rate is estimated at 5.39%, which is promising for income-focused investors.

The debt-to-EBITDA ratio for EPD is 3.23, which places it in the moderate range. This level indicates manageable financial leverage, though sector-specific risks should be considered.

Modest Undervaluation with Growth Potential

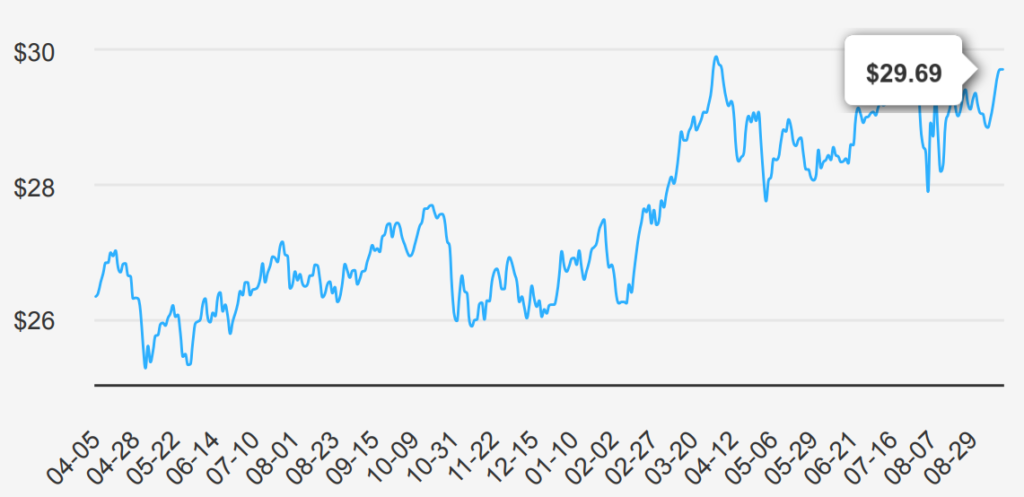

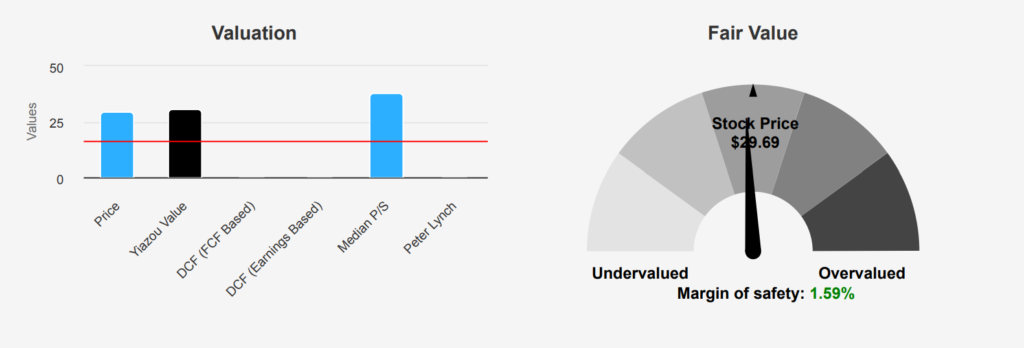

Enterprise Products stock currently shows a market price of $29.69, slightly below its intrinsic value of $30.17. It suggests a modest margin of safety of 1.59%. The stock’s Forward P/E ratio of 10.35 is lower than its trailing twelve-month (TTM) P/E ratio of 11.33. This indicates potential earnings growth or undervaluation compared to past performance. Historically, EPD’s P/E has fluctuated between a high of 28.09 and a low of 6.71 over the past decade, with a median of 13.70. It suggests the current P/E is relatively conservative.

EPD’s TTM EV/EBITDA ratio stands at 10.06, below the 10-year median of 11.64 but comfortably above the low of 7.65. This indicates a balanced valuation, although still on the lower end historically. The Price-to-Sales ratio (TTM) of 1.19 is below the 10-year median of 1.55. This suggests the stock may be undervalued relative to its sales. The Price-to-Free-Cash-Flow ratio (TTM) of 17.94 is below its 10-year median of 24.70. It indicates a reasonable valuation given the company’s cash flow generation.

The TTM Price-to-Book ratio of 2.3 slightly trails its 10-year median of 2.35, providing a neutral view on book value. With analysts’ stable price target of around $33.62, EPD appears fairly valued with a slight upside potential. Analyst sentiment remains positive, maintaining consistent price targets over recent months, suggesting confidence in the company’s future performance. This data collectively points to EPD being a stable investment with a slight undervaluation, offering a reasonable margin of safety given its current price dynamics.

Balancing Risks and Rewards in Enterprise Products Partners

Enterprise Products Partners presents a mixed risk profile. The company’s long-term debt issuance, totaling $1.8 billion over three years, suggests a growing financial obligation, yet it remains at acceptable levels. However, the Altman Z-score of 1.91 indicates potential financial stress, nearing the threshold that could suggest bankruptcy risk. The gross and operating margins are declining, with average annual declines of 4.8% and 4.6%, respectively. This highlights operational challenges that could affect profitability. Additionally, EPD’s revenue growth has slowed, and its dividend payout ratio of 0.77 raises concerns about the sustainability of its dividends.

On the positive side, EPD’s Piotroski F-Score of 9 reflects robust financial health, reducing the likelihood of financial distress. The company’s PE ratio, near a one-year low, suggests that the stock may be undervalued against its historical performance, potentially offering a buying opportunity. Insider buying activity further supports confidence in the company’s prospects. Nonetheless, the EPD stock’s current price is near its five-year high, and a PS ratio close to a two-year high warrants caution, as these factors may limit future capital appreciation.

Insider Trends: Confidence Drives Enterprise Products Stock

The insider trading activity for Enterprise Products stock over the past year shows a trend of buying rather than selling among company insiders. Over the last 12 months, there have been 3 insider purchases and no sales. This indicates a positive sentiment from the company’s directors and management. This buying pattern is consistent over shorter time frames as well, with 1 buy and no sales recorded in both the 3-month and 6-month periods. This activity suggests insiders may be confident in the company’s future performance.

With insider ownership at 0.95%, insiders hold a modest stake, but their buying actions could reflect a belief in the company’s growth prospects. Additionally, institutional ownership stands at 25.25% for Enterprise Products stock. It suggests a significant level of interest and investment from larger financial entities. This combination of insider and institutional confidence could be seen as a positive signal for potential investors. This highlights a potentially strong outlook for the company’s stock.

EPD Stock Trading Volume: Decrease In Liquidity

Enterprise Products stock exhibits a trading volume of 3,006,694 shares per day, which is notably below its average daily trade volume over the past two months of 4,762,173 shares. This indicates a current decrease in trading activity. This is potentially suggesting a lack of recent investor interest or market movements that are affecting liquidity.

The Dark Pool Index (DPI) for EPD is 45.38%, suggesting that a significant portion of its trading occurs in dark pools, private exchanges where trades are executed anonymously. A DPI below 50% typically suggests that more trades are happening on public exchanges rather than in dark pools, indicating transparency in trading and potentially less liquidity than stocks with higher DPI values.

Given these factors, EPD stock’s liquidity appears moderate, with lower-than-average trading activity and a mid-range DPI. Investors should consider monitoring changes in trading volume and DPI, as shifts could indicate changes in market sentiment or liquidity conditions.

Fluctuating Government Contracts: Trends and Implications

In 2017, EPD secured a government contract worth $1 million. However, there was a significant decline in 2018, with the contract value dropping to $150,000. The following year, 2019, saw a recovery, with the contract amount increasing to $500,000. This trend indicates fluctuations in EPD’s government contract engagements, reflecting potential changes in government budget allocations or EPD’s competitive positioning in securing contracts during those years.

Congressional Trading Moves: Virginia Foxx’s EPD Transactions

In the recent trading activity of Representative Virginia Foxx, a Republican from the House of Representatives, two significant transactions were reported involving Enterprise Products stock. On June 23, 2022, Foxx sold EPD shares valued between $100,001 and $250,000. This sale was reported on July 5, 2022. Prior to this, on May 13, 2022, she had purchased EPD shares valued between $1,001 and $15,000, which was reported on June 4, 2022.

The substantial sale in June suggests a strategic decision to liquidate a significant portion of her holdings in EPD, potentially to capitalize on market conditions or reallocate portfolio resources. The earlier purchase in May indicates an initial interest in EPD prior to the decision to sell a larger stake. This pattern of trading could reflect a short-term investment strategy or a response to changing market assessments of EPD’s financial outlook.

Disclosures:

On the date of publication, Yiannis Zourmpanos did not hold (either directly or indirectly) any positions in the securities mentioned in this article. This report has been generated by our stock research platform, Yiazou IQ, and is for educational purposes only. It does not constitute financial advice or recommendations.