Chevron Stock Represents The Second-largest US Oil Company

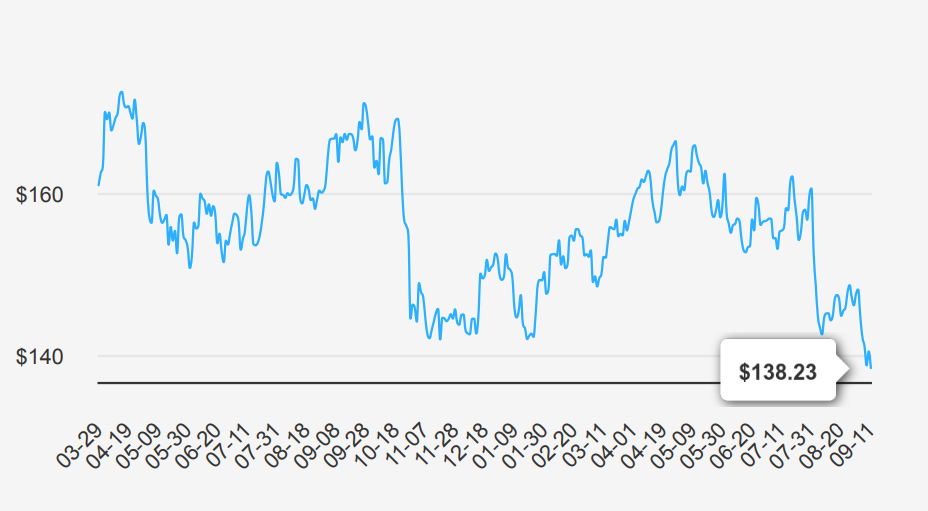

Chevron is an integrated energy company with worldwide exploration, production, and refining operations. It is the second largest oil company in the United States, producing 3.1 million barrels of oil equivalent a day, including 7.7 million cubic feet a day of natural gas and 1.8 million barrels of liquids daily. Production activities take place in North America, South America, Europe, Africa, Asia, and Australia. Its refineries are in the US and Asia, with a total refining capacity of 1.8 million barrels of oil a day. Proven reserves at year-end 2023 stood at 11.1 billion barrels of oil equivalent, including 6.0 billion barrels of liquids and 30.4 trillion cubic feet of natural gas. Chevron stock is trading at ~$138.

Chevron’s Earnings & Growth

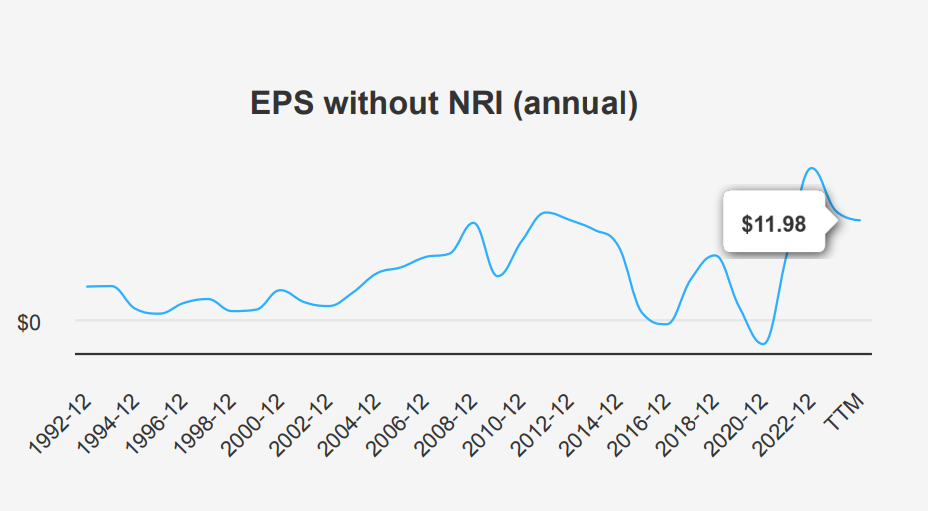

In the latest quarter ending June 30, 2024, Chevron Corporation (CVX) reported an EPS without non-recurring items (NRI) of $2.55. This reflects a decrease from the previous quarter’s $2.93 and the year-ago figure of $3.08. The EPS diluted stood at $2.43 compared to $2.97 in Q1 2024, highlighting a decline in earnings performance. Revenue per share increased to $27.039 from $25.19 in the prior quarter, indicating improved sales performance despite the earnings dip. Over the past 5 and 10 years, Chevron’s annual EPS without NRI has remained stable, showing no compound annual growth rate (CAGR). This suggests consistent performance amidst fluctuating market conditions.

Chevron’s gross margin for the quarter was 30.06%, slightly above its 5-year median of 29.20%, demonstrating stable operational efficiency. The company executed a share buyback ratio of 2.10% over the last year, indicating a strategic repurchase of shares. This potentially supports EPS by reducing the number of shares outstanding. This buyback activity was significantly higher than the 10-year median buyback ratio of 0.25%. It reflects a more aggressive capital return strategy in the recent period.

Looking ahead, analysts anticipate Chevron’s revenue to decline slightly over the coming years, with estimates of $200.7 billion for 2024, dropping to $194.98 billion by 2026. The estimated EPS for the next fiscal year-end ranges from $11.161 to $12.939. This suggests a positive outlook for Chevron stock despite current challenges, allowing for a more stable Chevron share price forecast.

Chevron’s Performance Return Is Improving

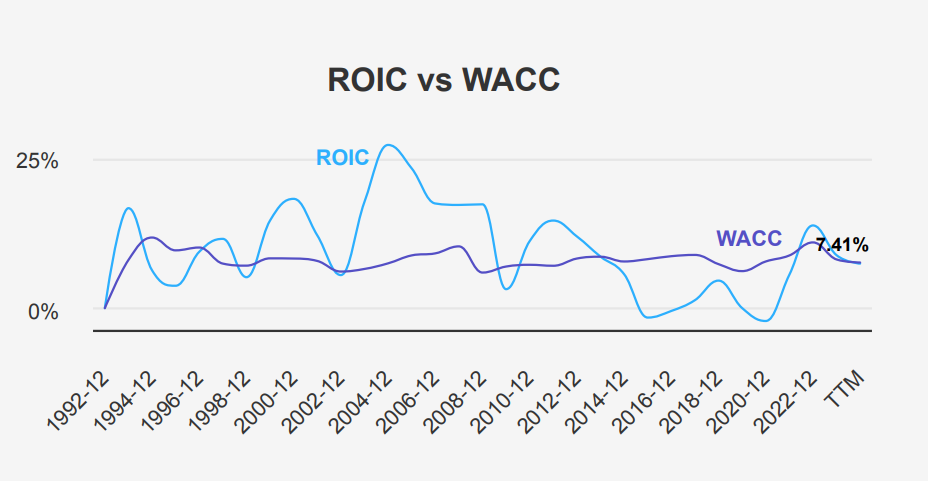

Over the past five years, CVX’s ROIC has had a median of 5.55%, below its five-year median WACC of 8.10%. This suggests that CVX was not generating sufficient returns during this period to cover its cost of capital, indicating potential value erosion.

Furthermore, the ROIC has seen significant fluctuations over the past decade, with a high of 13.75% and a low of -2.13%, indicating volatility in performance. The improvement in recent ROIC figures and a decreasing WACC suggest that CVX may be on a trajectory toward more stable and positive economic value creation. It reflects potential improvements in operational efficiency and strategic capital allocation.

Chevron Stock Provides Forward Dividend Yield of 4.7%

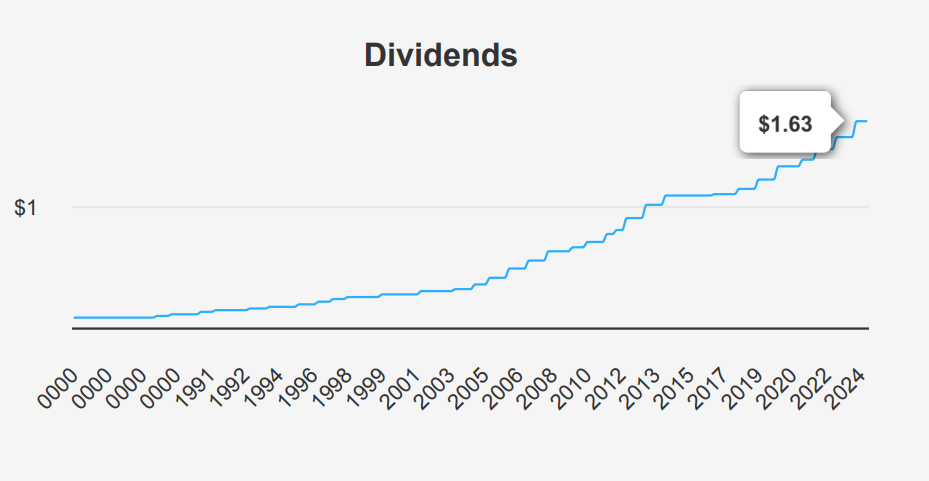

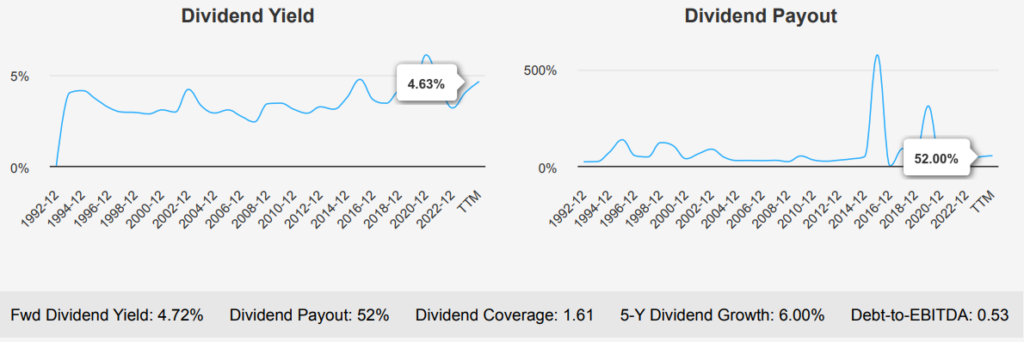

Chevron stock demonstrates robust dividend performance with a consistent growth pattern. Over the most recent quarter, CVX maintained its dividend per share (DPS) at $1.63, a rise from $1.51 in earlier quarters, reflecting steady growth. The 5-year dividend growth rate stands at 6.00%, with a slightly lower 3-year rate of 5.40%. This indicates stable but slightly decelerating growth.

The company’s forward dividend yield of 4.73% compares favorably against its historical median of 3.96%. This points to attractive returns for investors in the current market environment. The dividend payout ratio is 52%, significantly lower than its historical highs, which indicates a conservative approach, leaving room for future increases.

CVX’s debt-to-EBITDA ratio is 0.53, well below the general guideline of 2.0, which signifies strong financial health and excellent capacity to manage debt obligations. This low leverage enhances Chevron’s ability to sustain and possibly increase dividends.

The future dividend growth rate estimate for 3-5 years is 6.02%, which aligns with historical trends. Predicted from the current pattern, the next ex-dividend date is November 15, 2024, confirming Chevron’s commitment to regular dividend distributions.

Chevron Share Price Forecast

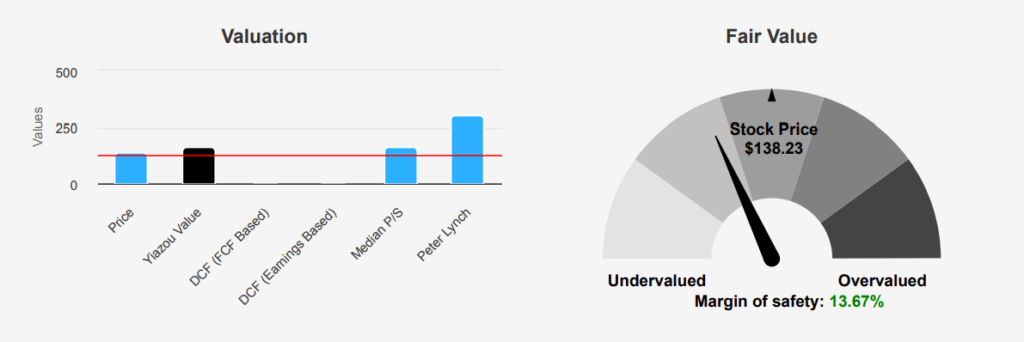

Chevron stock appears to be trading below its intrinsic value of $160.12, with a current market price of $138.23, offering a margin of safety of approximately 13.67%. The trailing twelve-months (TTM) Price-to-Earnings (P/E) ratio of 13.69 is lower than its 10-year median of 16.03, suggesting potential undervaluation. Similarly, the Forward P/E ratio stands at 10.48, indicating a favorable valuation compared to historical highs. The EV/EBITDA TTM of 6.17 is also below the 10-year median of 7.37, indicating a relatively attractive earnings valuation before interest, taxes, depreciation, and amortization.

The Price-to-Sales (P/S) TTM ratio of 1.3 is slightly below the 10-year median of 1.51. It indicates that CVX is priced below its average sales multiple. The Price-to-Book (P/B) ratio TTM is 1.58 slightly above the 10-year median of 1.47 but well within a reasonable range. This reflects a balanced valuation in terms of book value. The Price-to-Free-Cash-Flow (P/FCF) TTM ratio of 14.19 aligns closely with its 10-year median of 14.89. This suggests that CVX trades at a fair value based on free cash flow generation.

Analyst ratings suggest a positive outlook for CVX, with a current price target of $174.83, indicating a potential upside from the current price. Although this target has slightly decreased over the past three months, the consensus among analysts remains bullish. Compared to its historical averages, CVX’s valuation metrics suggest that the stock is undervalued, providing investors with a potential buying opportunity, especially given the existing margin of safety. All the above metrics and multiples provide ground for a more sound Chevron share price forecast.

Chevron Stock Has Low-Risk Profile

Chevron Corporation presents a mixed risk profile. The declining revenue per share over the past year suggests potential challenges in maintaining robust sales performance, which could impact future earnings and investor confidence. This downward trend in revenue indicates a need for strategic reassessment to stimulate growth and stabilize revenue streams.

However, several financial indicators suggest a stable foundation for Chevron. The Beneish M-Score of -2.76, significantly below the threshold of -1.78. This indicates a low likelihood of earnings manipulation, reflecting transparency and reliability in financial reporting. The Price-to-Book (PB) ratio at 1.58 is at a two-year low, suggesting the stock may be undervalued relative to its book value. It potentially offers an attractive entry point for investors. Similarly, the Price-to-Sales (PS) ratio close to its three-year low implies market undervaluation relative to sales capacity.

Chevron’s dividend yield nearing a two-year high could appeal to income-focused investors, providing a buffer against market volatility. The strong Altman Z-score of 3.73 also suggests financial stability, indicating low bankruptcy risk. Overall, while declining revenues are a concern, Chevron’s strong financial health and undervaluation metrics are the fundamental basis of the Chevron share price forecast and may offer a compelling investment opportunity for those focusing on long-term stability and income.

Chevron Stock’s Insider Selling Hinders Short-Term Prospects?

An analysis of insider trading trends for Chevron Corporation over the past year reveals a notable absence of buying activity by insiders, with no purchases recorded in the last 3, 6, or 12 months. Conversely, there have been five instances of insider selling over the past 6 and 12 months. It indicates a potential reduction in insider-held shares. This selling activity might suggest a lack of confidence in the stock’s short-term prospects or a need for liquidity among insiders.

Insider ownership stands at a relatively low 0.06%, suggesting that company executives and directors hold a minor stake in the firm. This level of ownership can sometimes imply a lesser alignment with shareholder interests. On the other hand, institutional ownership is robust at 75.26%, which often reflects confidence from larger investors and can provide stability to the stock. Overall, the lack of insider buying combined with consistent selling could warrant careful observation by potential investors in Chevron’s share price forecast, especially when considering long-term investment strategies in CVX.

Chevron Stock Holds Robust Liquidity

CVX has demonstrated robust liquidity and trading activity. The average daily trading volume over the past two months is approximately 7.3 million shares, which indicates a healthy level of market activity. On the most recent day, CVX traded 8,170,845 shares, surpassing its two-month average. This suggests a heightened interest in the stock, potentially driven by recent market events or announcements.

The Dark Pool Index (DPI) for CVX stands at 60.36%, indicating a significant portion of trading occurs in non-public exchanges. A DPI above 50% suggests that most trades happen in dark pools. This could mean larger institutional trades are being executed away from the main exchanges to minimize market impact.

Overall, CVX’s trading activity represents strong liquidity, high trading volumes, and notable institutional participation. This liquidity profile gives investors confidence in their ability to enter and exit positions in CVX efficiently.

Government Contracts

Chevron has demonstrated a fluctuating trajectory in government contracts over the years. From a low of $20 million in 2019, the amount surged to approximately $115 million in 2020. Then, it decreased to $64 million in 2021. However, 2022 saw a significant increase to $165 million, followed by a rise to $197 million in 2023. The projection for 2024 suggests a decline to $93 million. This indicates volatility possibly tied to changing governmental energy policies and market conditions.

U.S. Patents

Between 2015 and 2020, CVX showed a fluctuating patent filing trend. In 2015, they filed 4 patents, which increased slightly to 5 in 2016. The number of patents dipped back to 4 in 2017, then rose to 6 in 2018. However, filings decreased to 4 in 2019 and sharply to 2 in 2020. This pattern suggests inconsistent innovation output, possibly reflecting shifting strategic priorities or external influences affecting research and development efforts.

Congress Trading

Two significant sales of Chevron Corporation shares were reported in recent trades involving Congress members. On September 4, 2024, Representative John James, a Republican from the House of Representatives, sold CVX shares valued between $1,001 and $15,000. This transaction was documented on September 6, 2024, and later updated on September 9, 2024. Earlier, on June 21, 2024, Democrat Representative Josh Gottheimer also sold CVX shares within the same value range. This transaction was reported on July 9, 2024, with the last modification noted on July 10, 2024.

Both transactions indicate a bipartisan interest in divesting from Chevron, possibly reflecting broader market trends or personal portfolio adjustments. These sales might signal strategic moves in response to fluctuating oil prices or anticipated regulatory changes impacting the industry. Monitoring such trades can offer insights into potential shifts in market sentiment or legislative focus on energy companies.