Starbucks: A Widely Recognized Restaurant Brand

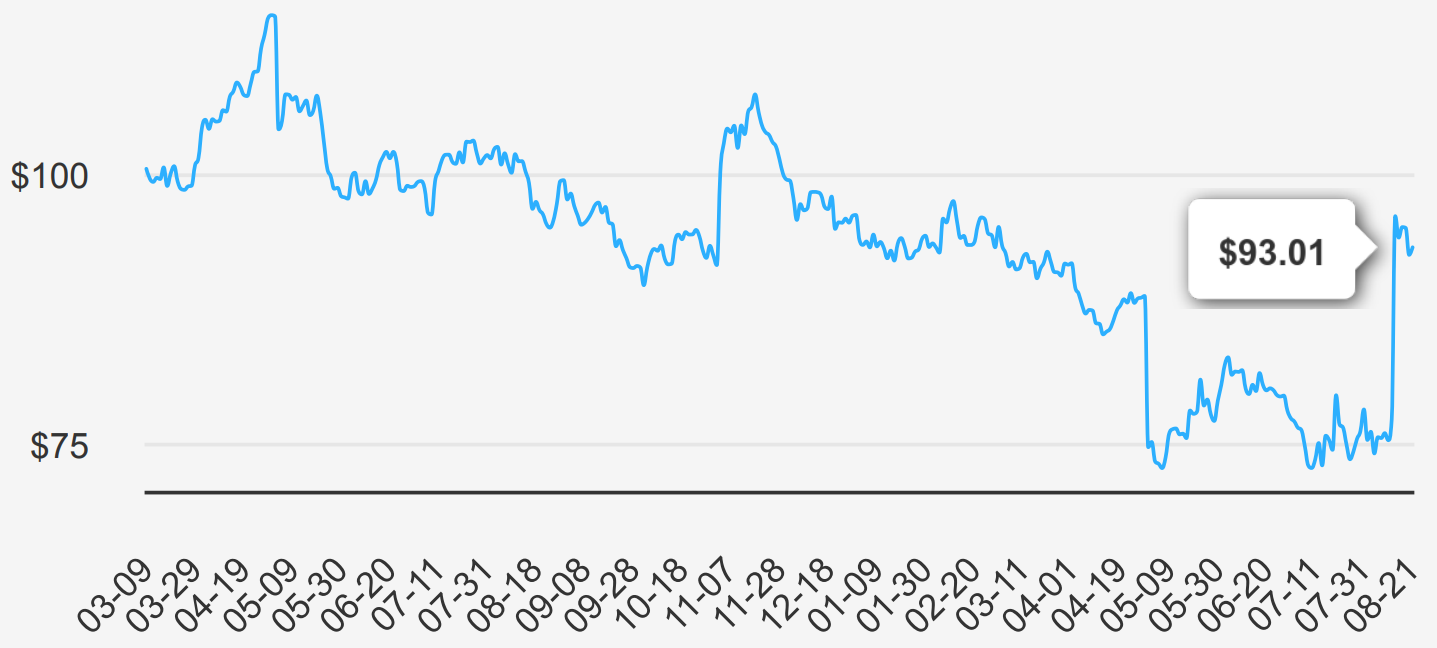

Starbucks is one of the most widely recognized restaurant brands in the world, operating more than 38K stores across more than 80 countries as of fiscal 2023. The firm operates in three segments: North America, international markets, and channel development (grocery and ready-to-drink beverages). The coffee chain generates revenue from company-operated stores, royalties, sales of equipment and products to license partners, ready-to-drink beverages, packaged coffee sales, and single-serve products. Starbucks stock is currently trading at nearly $93.

Starbucks Holds Solid Earnings & Growth

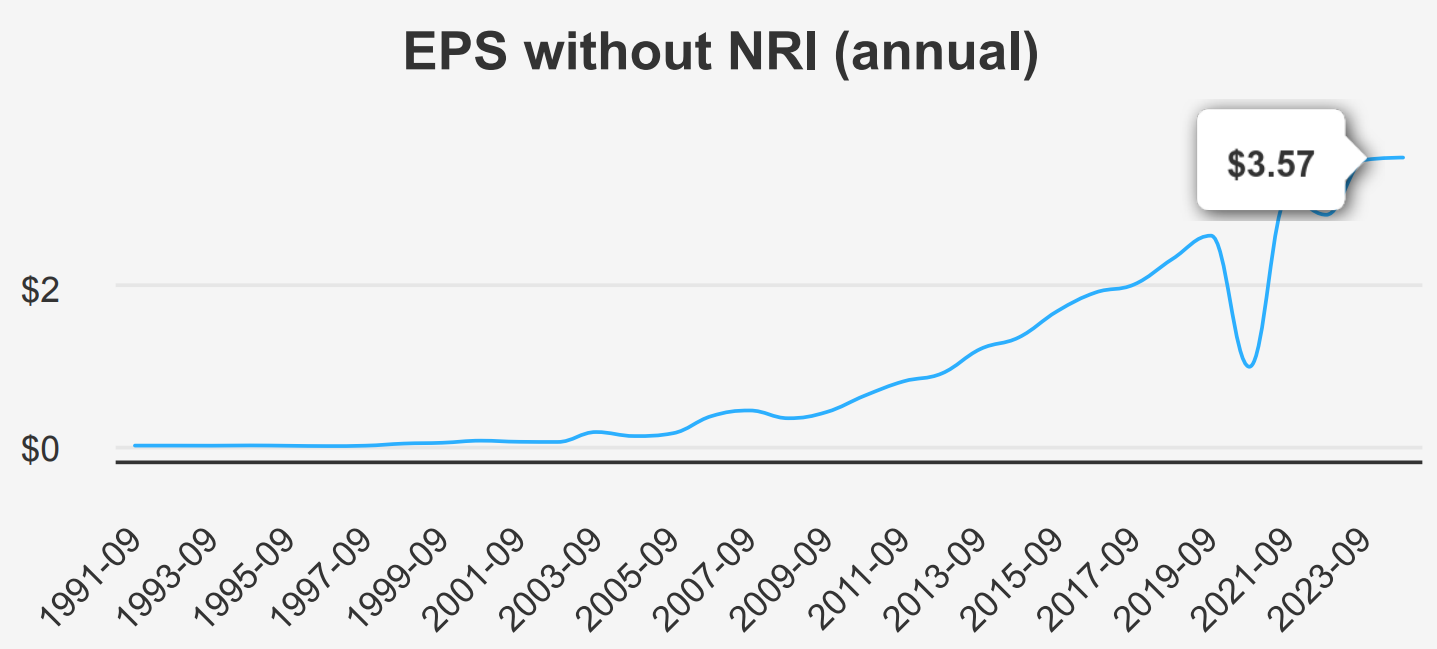

The company delivered an EPS without NRI of $0.93 in Q2 of 2024, up from $0.68 in Q1. The revenue per share also increased to $8.024 from $7.542 in the previous quarter. Comparing the current quarter’s performance to the 5-year and 10-year CAGR of 10.70% and 8.80%, respectively, Starbucks continues to show strong growth potential. Industry growth forecasts for the next 10 years are optimistic, providing a favorable outlook for Starbucks’ future earnings. The latest quarter-end date was June 30, 2024.

Starbucks’ Performance: Consistent Returns And Positive Value Creation

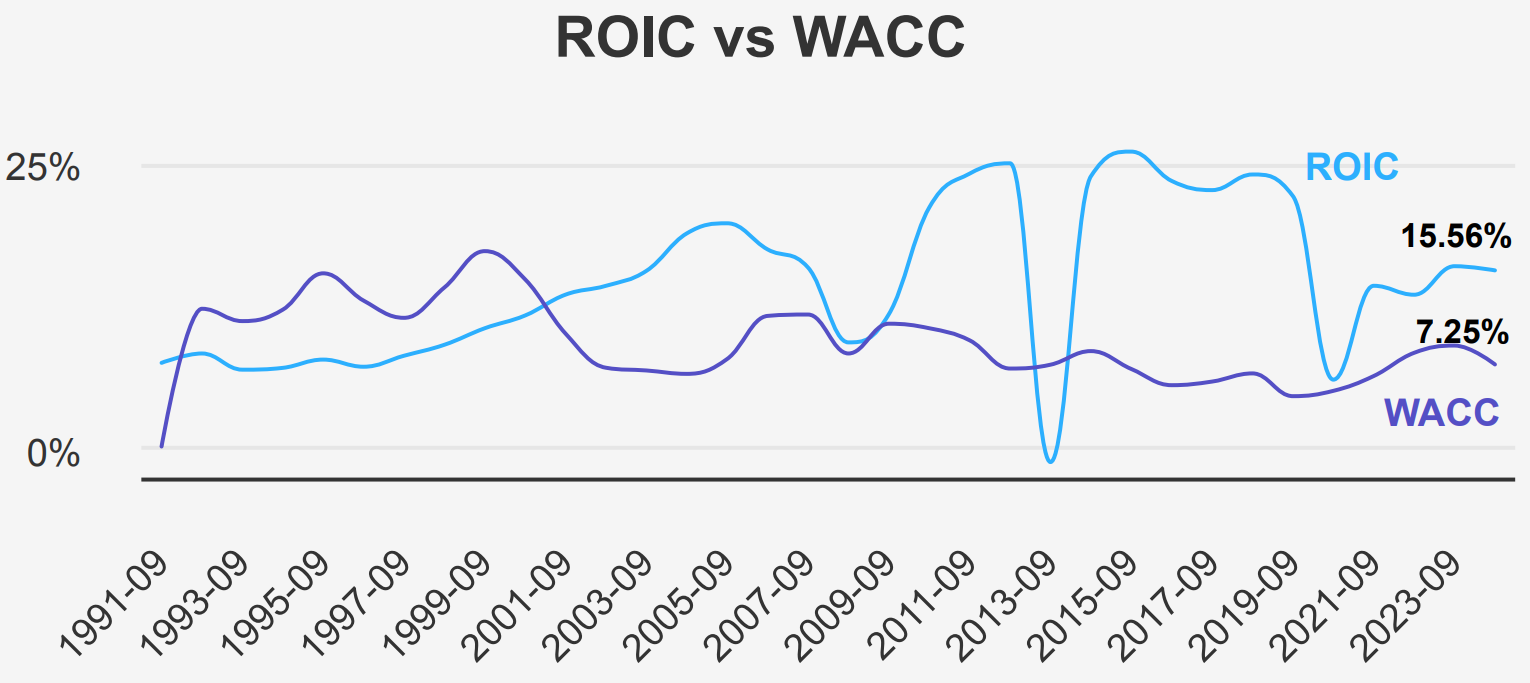

The company has shown a consistent return on assets (ROA) of 13.82% over the past 5 years, indicating efficient asset utilization. However, it has experienced negative equity returns over the same period. The return on invested capital (ROIC) has been 14.20%, slightly higher than the weighted average cost of capital (WACC) of 6.23%, suggesting positive value creation. The Joel Greenblatt ROC metric of 39.19% also reflects strong capital allocation.

Looking at the longer-term trends, the company has had fluctuations in ROE, with both high and low extremes. The WACC has ranged from 4.45% to 8.92% over the past 10 years, with a median of 6.35%. The ROIC has varied between 5.91% and 26.05%, with a median of 22.39%. Overall, the company’s performance has been solid, with higher ROIC compared to WACC, indicating value creation for shareholders.

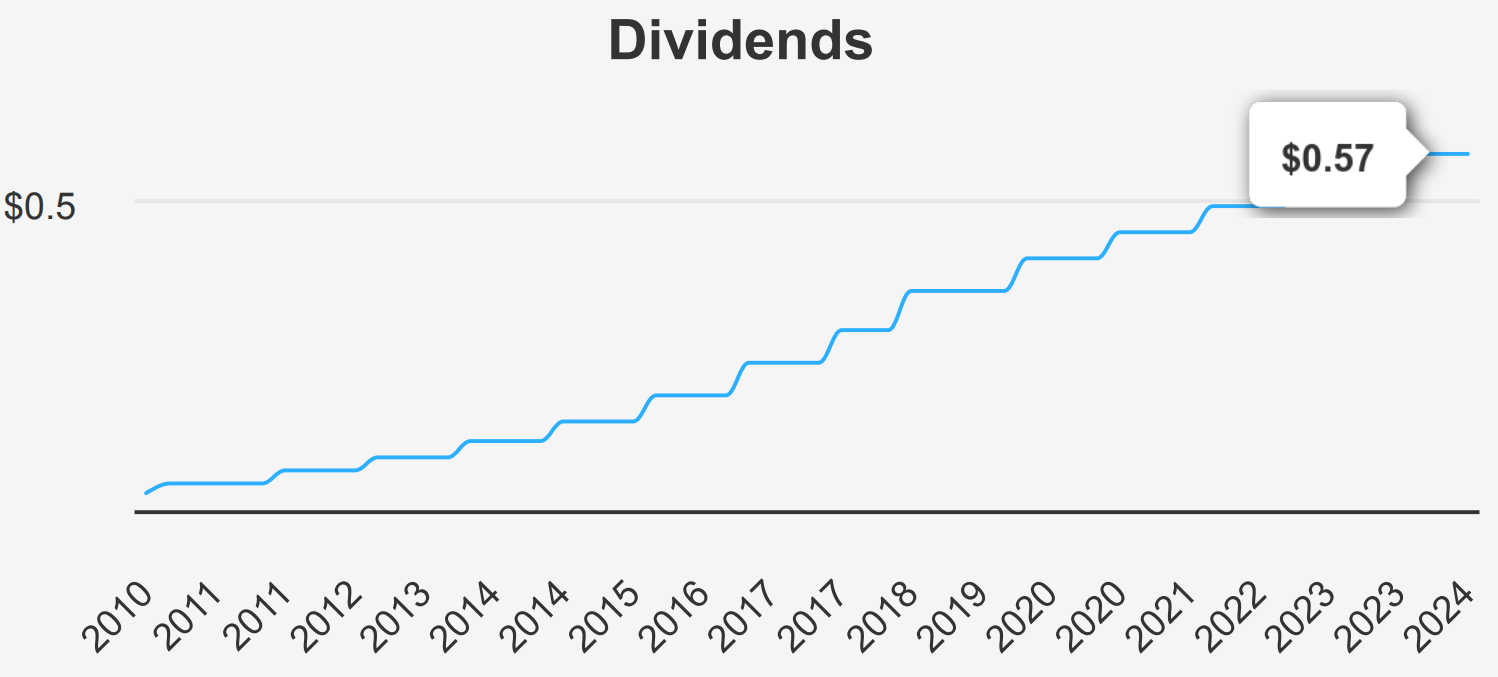

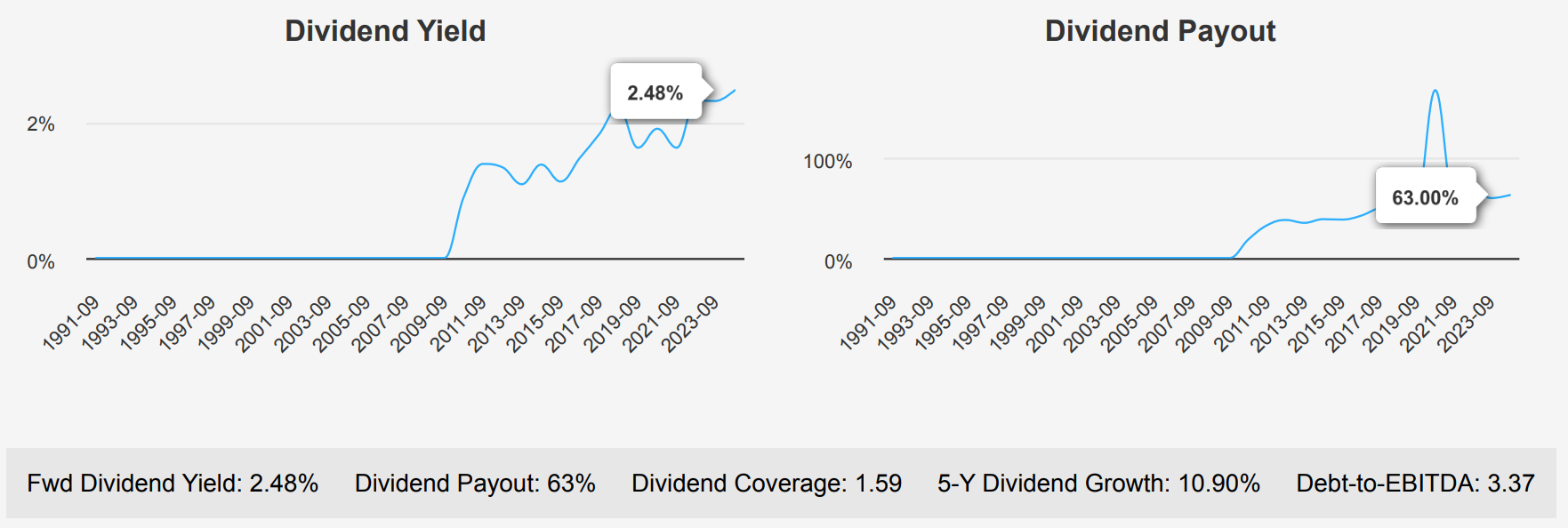

Starbucks Stock Provides A Forward Dividend Yield of 2.5%

Starbucks has shown consistent dividend growth over the past few years, with a 5-year dividend growth rate of 10.90% and a 3-year growth rate of 8.90%. The current forward dividend yield stands at 2.47%, indicating a decent return for investors.

Moreover, the debt-to-EBITDA ratio of 3.37 is considered moderate, falling within the range of 2.0 to 4.0. This suggests that Starbucks has a reasonable level of financial risk and debt-servicing capacity. However, investors should be cautious and monitor this ratio, especially considering the industry’s standards.

The Dividend Payout Ratio of 63.0% is below the 10-year high of 101.68%, indicating that Starbucks has room to increase dividends further without straining its financials. The company has maintained a stable payout ratio over the past decade, with the current ratio being closer to the median of 100.55%.

In conclusion, Starbucks Corp has demonstrated a strong dividend growth performance and maintains a moderate debt-to-EBITDA ratio, indicating a balanced financial position.

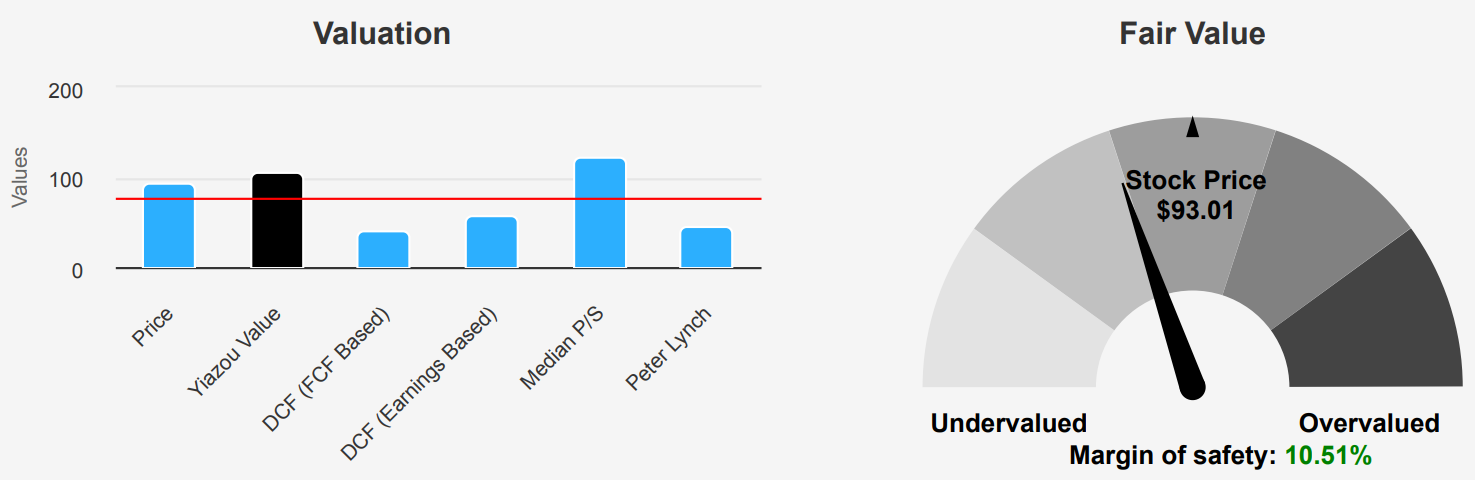

Starbucks Stock Is Undervalued

The current valuation of SBUX indicates an intrinsic value of $103.93 compared to its current price of $93.01. The P/S ratio stands at 2.89, while the EV/EBITDA ratio is 16.81. The PEG ratio is relatively high at 4.2, suggesting potential overvaluation. The price-to-free-cash-flow ratio is 27.75, reflecting a premium in the stock price. The forward PE ratio is 23.29, implying a positive outlook. Compared to its 5-year and 10-year averages, SBUX is trading at a premium, with the P/S and EV/EBITDA ratios above historical levels. The industry averages should be considered for a broader perspective on SBUX’s valuation.

Risk & Reward: Very Healthy Financial Standing

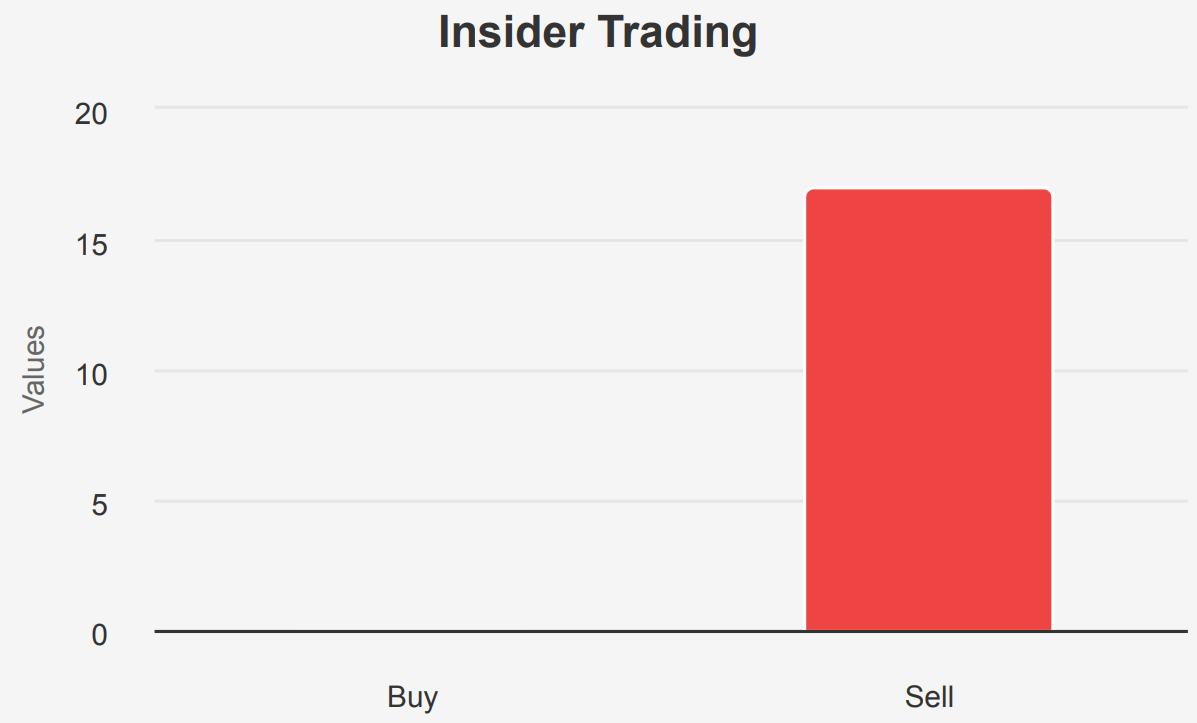

The risk assessment for SBUX stock indicates several concerning factors. The insider selling activity with no insider buying in the past 3 months, involving the sale of 9,790 shares, raises red flags about the confidence of company insiders in the stock. Additionally, the slowing revenue growth over the past 12 months is a negative indicator of future earnings potential.

On the positive side, the Piotroski F-Score of 8 suggests a very healthy financial situation for Starbucks Corp. The Beneish M-Score of -2.93, below the threshold of -1.78, indicates a low likelihood of financial manipulation. The expanding operating margin and strong Altman Z-score of 3.13 are also positive signs for the company’s financial health.

Overall, while there are some concerning factors, such as insider selling and slowing revenue growth, strong financial metrics like the FScore, M-Score, operating margin, and Z-score provide some reassurance about the company’s stability.

Starbucks Stock Insider Activity: Red Flags

The insider trading analysis for Starbucks (SBUX) shows a significant trend of insider selling over the past 12 months, with 17 insider sell transactions and no insider buys reported. This high level of insider selling may indicate that company insiders, including directors and management, have been divesting their shares. This is potentially signaling a lack of confidence in the company’s future prospects. Insider ownership stands at 2.14%, suggesting limited direct investment by insiders in the company.

On the other hand, institutional ownership is relatively high at 79.1%, indicating that institutional investors, such as mutual funds and pension funds, have a significant stake in SBUX. This may imply that institutional investors have confidence in Starbucks’ performance and growth potential. Overall, the insider trading activity and ownership levels suggest a cautious outlook for SBUX, with a notable absence of insider buying and a higher level of insider selling.

Starbucks Stock Holds High Liquidity

Starbucks (SBUX) has high liquidity with a volume_day of 11,523,908 shares traded. The average daily trade volume over the past 2 months is 17,102,082 shares, indicating consistent trading activity. The Dark Pool Index (DPI) is at 56.26%, showing that a significant portion of trading activity occurs in dark pools. This suggests that a large portion of SBUX trades are executed off-exchange, potentially impacting price discovery and market transparency. Overall, SBUX exhibits strong liquidity and trading activity, making it an attractive choice for investors seeking to buy or sell shares with minimal impact on price.

Government Contracts

Starbucks (SBUX) has seen fluctuations in its government contracts over the past six years. The amount of government contracts awarded to SBUX decreased significantly in 2018 and 2019 but rebounded in 2020 and 2021. The highest amount was recorded in 2016 at $854,602, followed by a steep decline in 2017. The latest data for 2021 shows a substantial increase in government contracts awarded to SBUX, reaching $682,348.

U.S. Patents

In the U.S., Starbucks (SBUX) has filed a total of 24 patents from 2015 to 2020. The number of patents filed by SBUX has been increasing over the years, with 2 patents filed in 2015 and reaching a peak of 7 patents in 2019. This indicates a strong focus on innovation and research within the company to protect its intellectual property and stay competitive in the market.