Johnson & Johnson: The World’s Largest Healthcare Firm

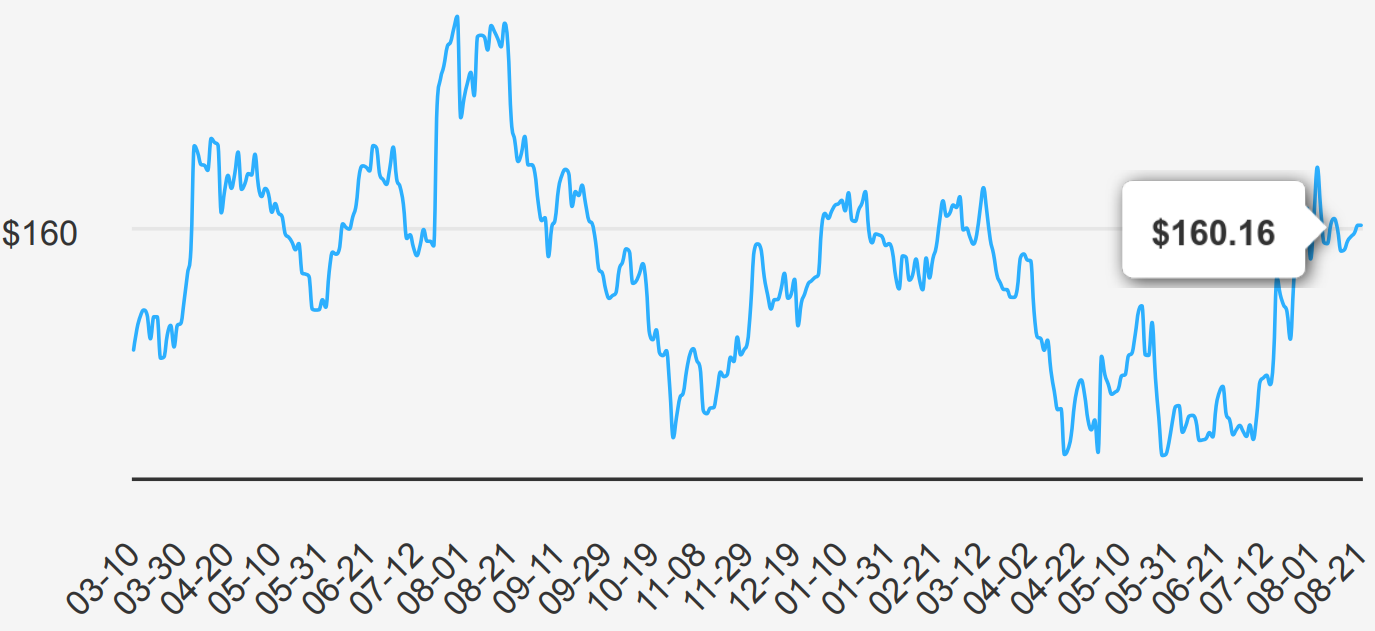

Johnson & Johnson is the world’s largest and most diverse healthcare firm. The company has two divisions: pharmaceuticals and medical devices. These now represent all of the company’s top-line after the divestment of the consumer business, Kenvue, in 2023. The drug division focuses on therapeutic areas like immunology, oncology, neurology, pulmonary, cardiology, and metabolic diseases. Geographically, over half of total revenue is derived in the US. Johnson & Johnson Stock is currently trading near $160.

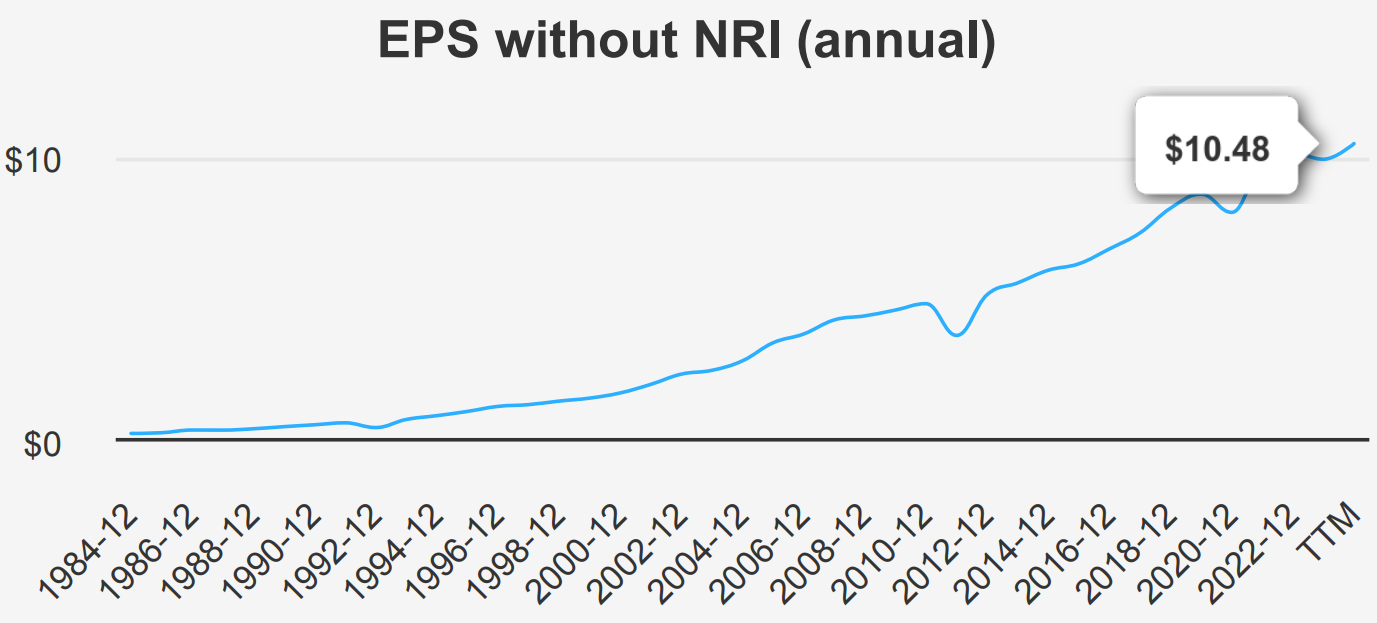

JNJ Has Stable Earnings & Growth

JNJ reported solid earnings for the latest quarter ending June 30, 2024. The EPS without NRI stood at $2.82, showing growth compared to the previous quarter. The company’s revenue per share also increased to $9.268. Compared with the 5-year and 10-year Compound Annual Growth Rate (CAGR) of 4.80% and 6.50%, respectively, JNJ continues to demonstrate stable growth. However, the diluted EPS experienced a slight decline from Q2 2023. Industry growth forecasts for the next 10 years indicate a positive outlook, which aligns well with JNJ’s historical performance.

Financial Performance Is Consistent

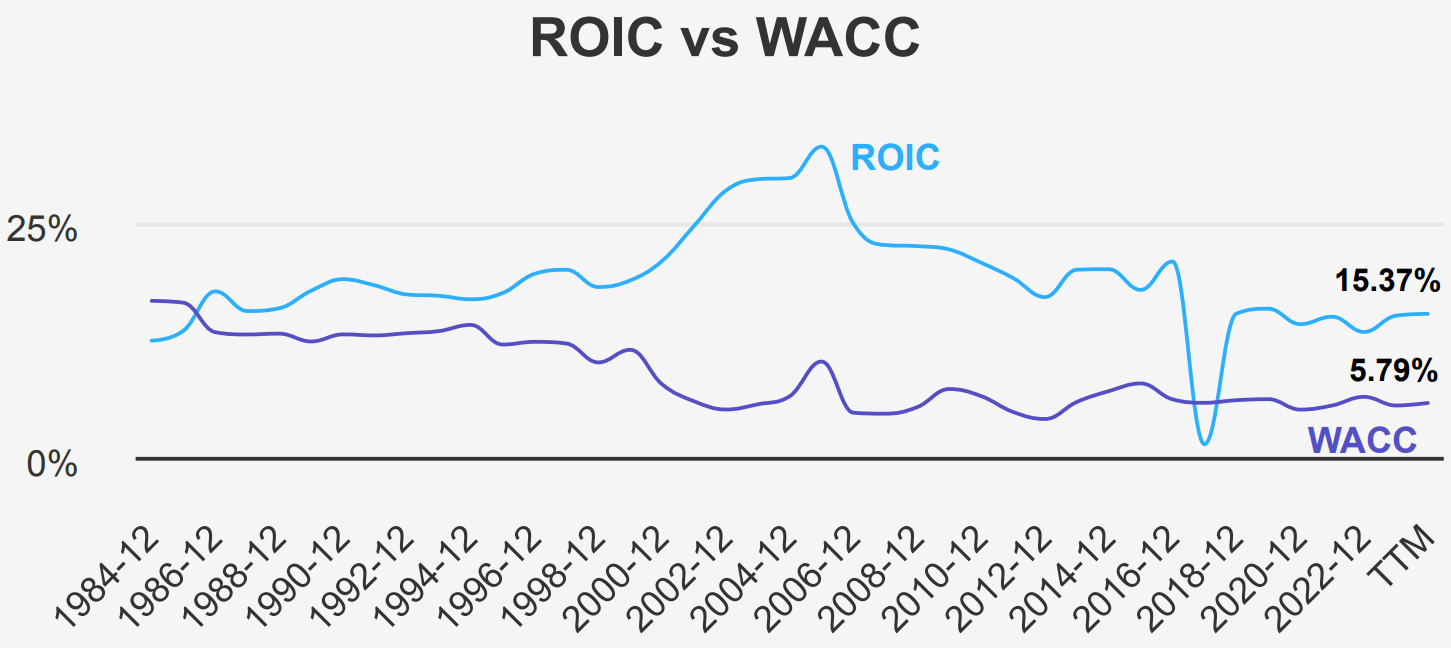

The company has shown consistent performance over the past 5 years with a 5-year median ROIC of 15.06%, which is higher than the WACC of 5.52%. This indicates that the company has been creating economic value for its shareholders as the ROIC exceeds the cost of capital. The company’s ROE has also been strong, with a 5-year median of 25.36% and a current ROE of 53.29%, showing efficient capital allocation and profitability.

Furthermore, the company’s ROC based on Joel Greenblatt’s formula has been impressive at 102.73%, indicating a high return on capital. The company’s ROIC has remained stable over the past 5 years at 15.37%, which is slightly higher than the 5-year median ROIC. This consistent performance suggests that the company is effectively utilizing its capital to generate returns above its cost of capital.

Overall, the company’s performance metrics indicate strong economic value creation, with ROIC consistently exceeding the WACC, reflecting efficient capital allocation and positive shareholder value.

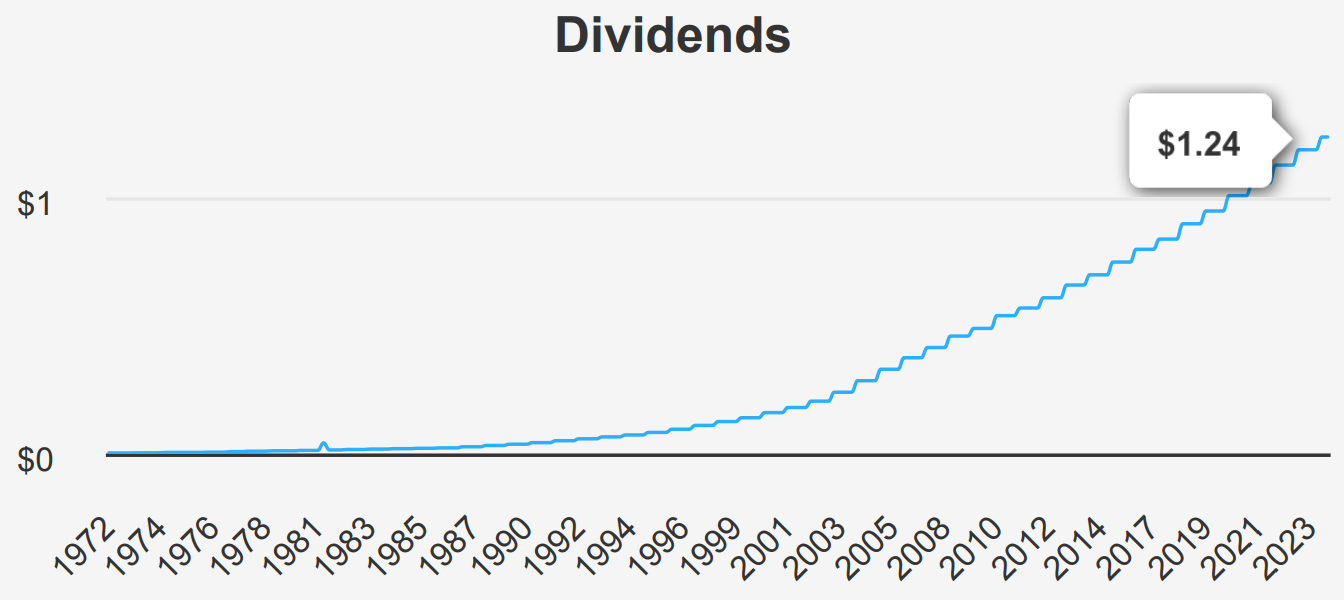

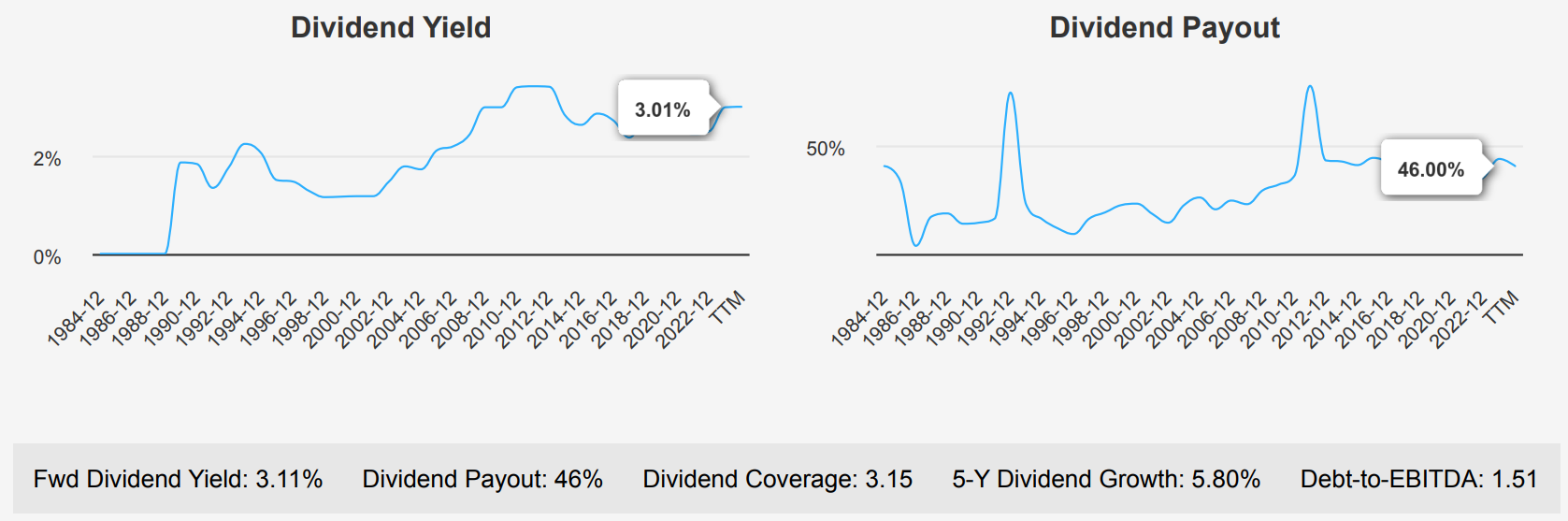

Johnson & Johnson Stock Offers Forward Dividend Yield of 3%

Johnson & Johnson (JNJ) has demonstrated consistent dividend growth over the past few years, with a 5-year average growth rate of 5.80% and a 3-year growth rate of 5.70%. The company’s most recent Forward Dividend Yield stands at 3.01%, indicating a healthy return for investors. The Dividend Payout Ratio is currently at 46%, suggesting that the company retains a significant portion of its earnings for reinvestment or other uses.

In terms of financial health, JNJ’s debt-to-EBITDA ratio of 1.51 falls below the 2.0 threshold, indicating lower financial risk and robust debt-servicing capacity. This suggests that the company has a strong ability to cover its debt obligations comfortably.

Comparing JNJ’s dividend performance with the sector, the company has maintained a stable dividend payout ratio over the past decade, with figures ranging from 43% to 50%. The dividend yield has also shown consistency, with a 10-year median yield of 2.64%.

In summary, Johnson & Johnson’s dividend growth remains attractive, and its low Debt-to-equity ratio reflects its strong financial position, providing investors with a sense of stability and potential for future dividend growth.

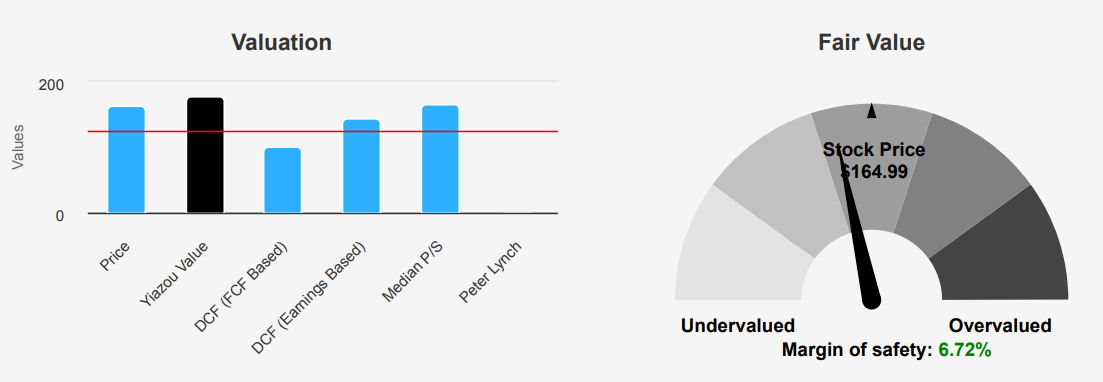

JNJ Stock Is Trading Below Its Intrinsic Value

JNJ is currently trading below its intrinsic value of $176.88 at $164.99. This provides a considerable margin of safety. The P/S ratio is higher than the 5-year and 10-year averages, suggesting rich valuation based on sales. The EV/EBITDA ratio is slightly higher than the 5-year average but lower than the 10-year average, implying a fair valuation based on earnings. The forward PE ratio is higher than the TTM PE, indicating growth expectations. Overall, the stock seems to be trading at a reasonable valuation based on EV/EBITDA and P/S ratios compared to historical averages.

Risk & Reward: A Mixed Profile

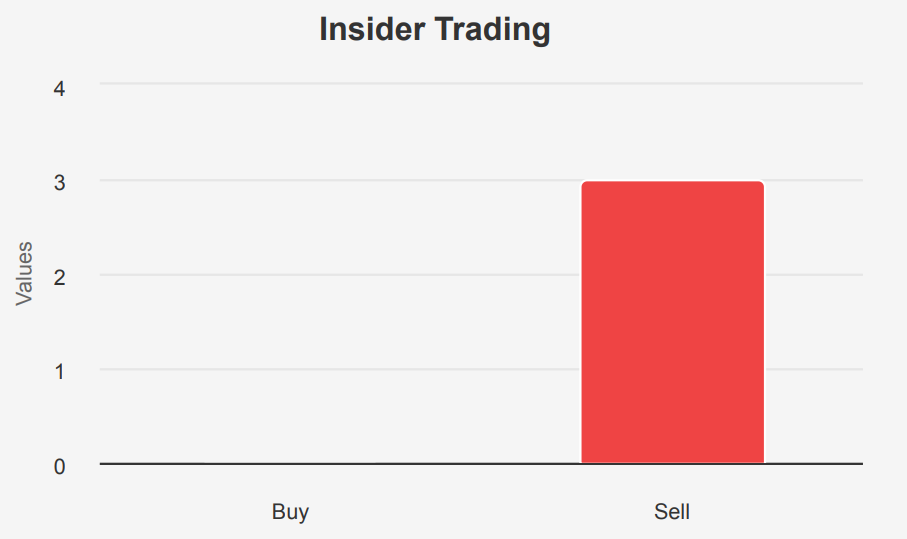

Johnson & Johnson Stock presents a mixed risk profile. While the company’s long-term debt level is acceptable, the recent trend of issuing new debt raises concerns. The insider selling activity, with 1 transaction and 5,635 shares sold in the past 3 months, may indicate a lack of confidence among insiders. Additionally, the company’s declining earnings, as reflected in the PE ratio, could be a red flag for investors. On the positive side, the British M-Score of -2.08 suggests that the company is unlikely to be a manipulator, and the expanding operating margin is a positive sign.

Furthermore, Johnson & Johnson has demonstrated consistent revenue and earnings growth, and the strong Altman Z-score of 3.08 provides reassurance about the company’s financial stability. However, investors should be cautious given the high stock price, which is close to a 10-year high.

Management Assessment

Johnson & Johnson’s CEO is known for his strategic vision and ability to drive innovation within the company. The management team under his leadership is focused on fostering a collaborative and inclusive work environment. The CEO’s leadership style emphasizes transparency, integrity, and a strong commitment to corporate responsibility. Employee ratings often highlight the CEO’s approachability and his dedication to fostering a positive workplace culture. Overall, Johnson & Johnson’s leadership is well-regarded for its focus on innovation, ethics, and employee well-being.

Johnson & Johnson Stock Insider Activity

In the past 12 months, Johnson & Johnson (JNJ) has not witnessed any insider buying activity, while there have been three instances of insider selling. This suggests that insiders within the company have been more inclined to sell their shares rather than buy, which could indicate a lack of confidence in the stock’s future performance. With an insider ownership of 0.19% and institutional ownership of 71.46%, it appears that institutional investors hold a significant portion of the company’s shares compared to insiders. The trend analysis of the company’s directors and management shows a lower level of insider ownership, possibly signaling a disconnect between management and the company’s stock performance.

JNJ Stock Has Good Liquidity & Trading Volume

Johnson & Johnson Stock has a high average daily trade volume of 7,015,585 shares over the past 2 months, indicating active trading interest. The daily volume of 4,481,327 shares suggests good liquidity for investors, enabling them to easily enter and exit positions. The Dark Pool Index (DPI) of 46.41% indicates that a significant portion of trading activity occurs in dark pools, which are private exchanges where institutional investors execute large trades away from public markets. This can impact price discovery and market efficiency. Overall, JNJ’s liquidity is robust, with ample trading volume and a notable presence in dark pools.

Government Contracts

Johnson & Johnson (JNJ) has been awarded government contracts totaling $7,184,437,251 from 2019 to 2024. The highest contract amount was in 2021, with $2,577,168,545, followed by 2020, with $2,431,057,136. The lowest contract amount was in 2024, with $463,815,070. JNJ’s government contracts show a fluctuating trend over the years, with significant variations in contract amounts.

U.S. Patents

JNJ has shown consistent growth in patent filings over the past five years, with 1,500 patents filed between 2016 and 2020. The highest number of patents were filed in 2018, totaling 350, followed by a slight decline in subsequent years. This indicates a strong emphasis on innovation and research within the company. JNJ’s patent portfolio reflects a commitment to developing new technologies and products across various sectors.