Overview

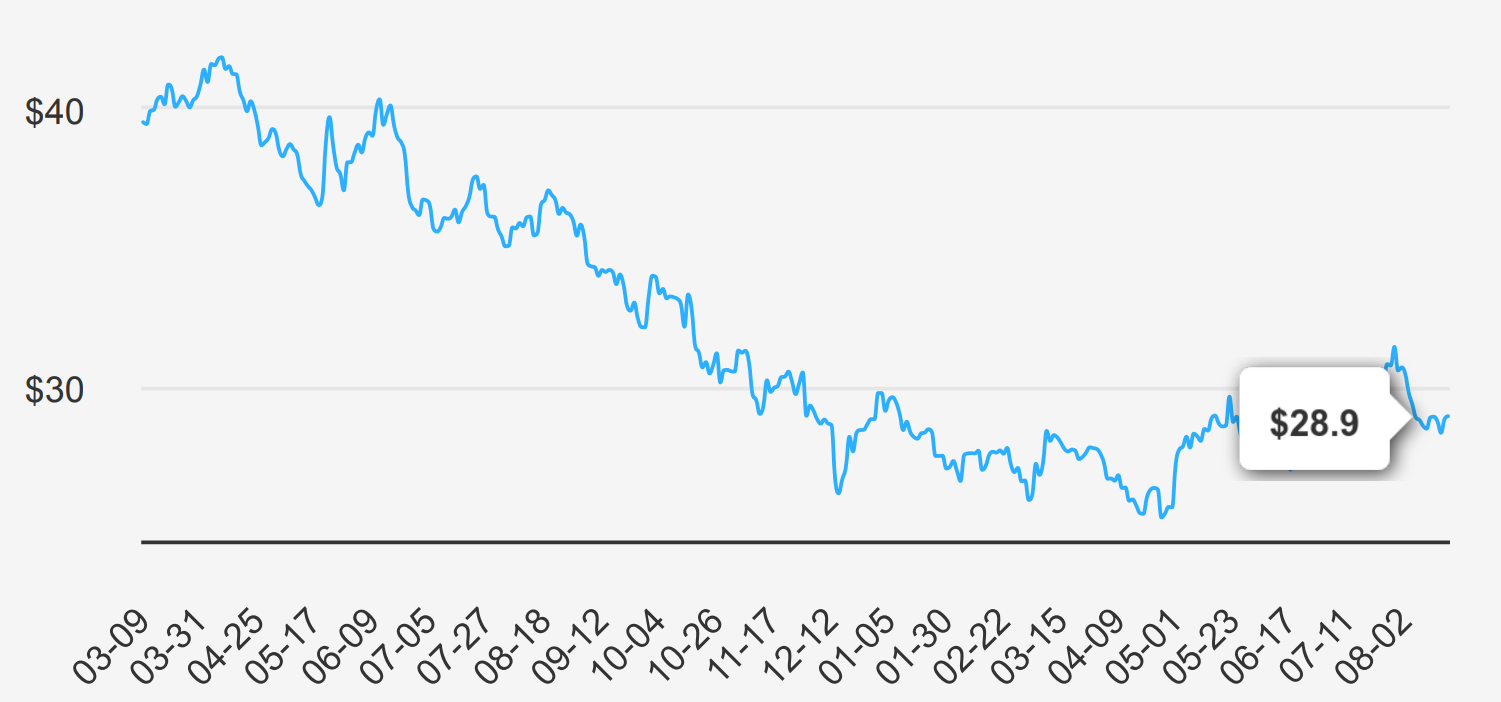

Pfizer is one of the world’s largest pharmaceutical firms, with an annual top-line close to $50 billion (excluding COVID-19 products). It historically offers numerous types of healthcare products and pharmaceutical drugs. However, now prescription drugs and vaccines account for the majority of sales. Top sellers include the pneumococcal vaccine Prevnar 13, the cancer drug Ibrance, and cardiovascular treatment Eliquis. Pfizer sells these products globally, and its international sales account for 50% of the total sales. Emerging markets are a major contributor to international sales. Pfizer stock is currently trading at $28.9.

Earnings & Growth

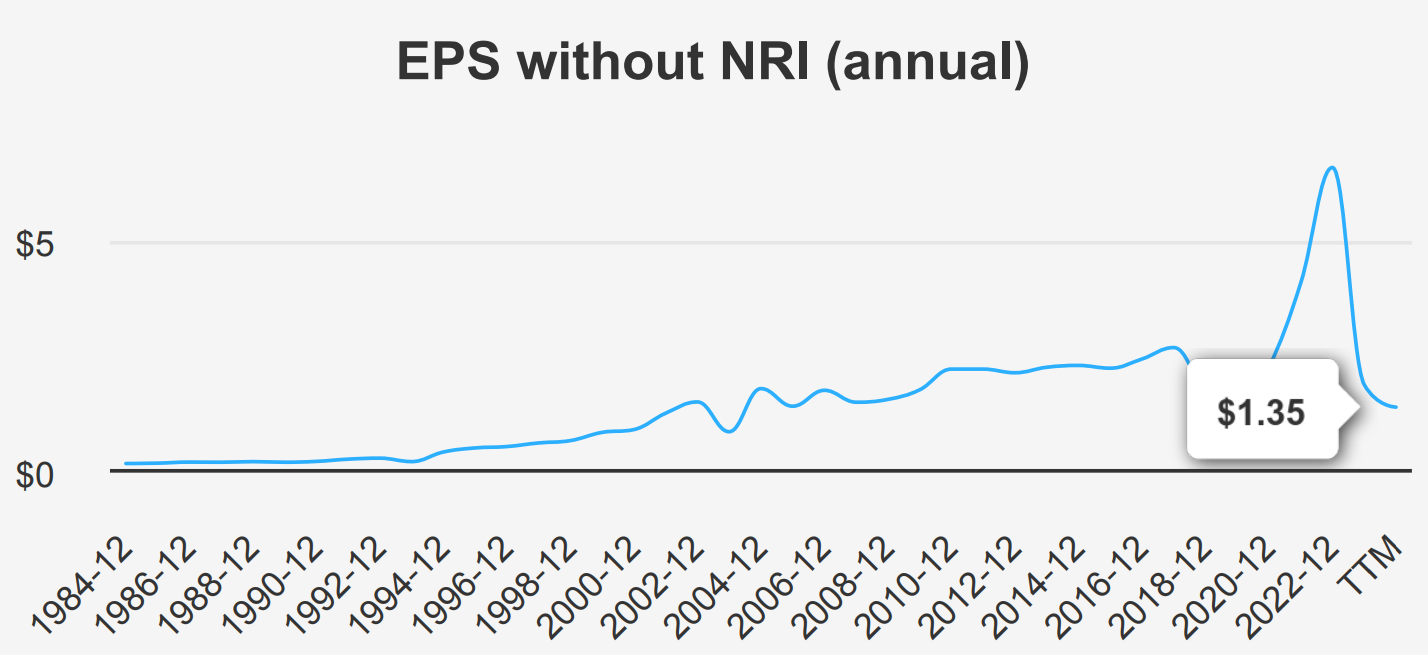

Pfizer (PFE) reported an EPS without NRI of $0.6 in the latest quarter ending June 30, 2024, a decrease from the previous quarter’s $0.82. The diluted EPS also dropped to $0.01 from $0.55 in the prior quarter. However, the revenue per share remained relatively stable at $2.332 compared to $2.612 in the previous quarter. Over the past 5 years, Pfizer has shown a 20.40% CAGR in EPS without NRI and a 3.80% CAGR over the last 10 years. The industry growth forecast for the next 10 years remains positive, indicating potential opportunities for Pfizer’s future performance.

Performance

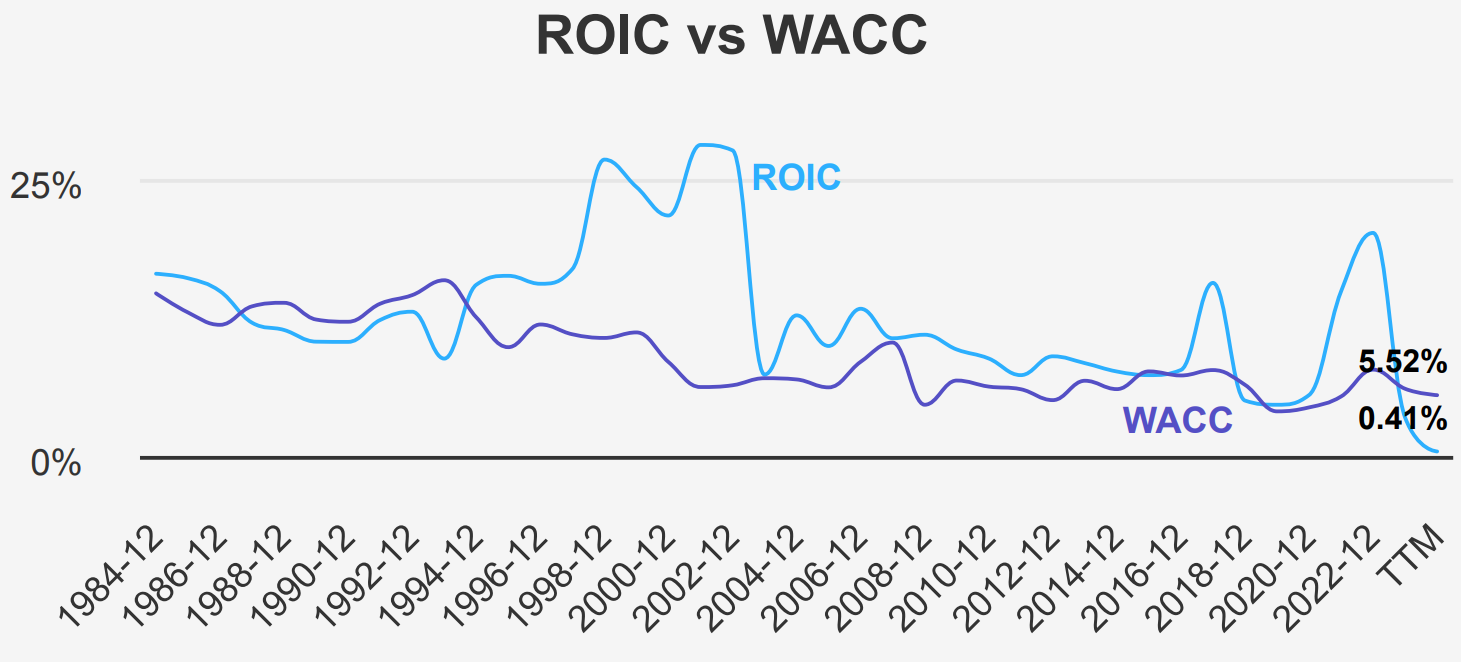

The company’s performance can be analyzed through various metrics. The Return on Assets (ROA) and Return on Equity (ROE) are essential indicators of profitability and efficiency. The 5-year median ROA of 9.80% suggests that the company is generating a decent return on its assets. However, the ROE has been inconsistent, with a 5-year median of 25.33% but a current ROE of -2.79%, indicating a recent decline in profitability. In terms of capital allocation, the Return on Invested Capital (ROIC) and Weighted Average Cost of Capital (WACC) are crucial. The 5-year median ROIC of 5.53% is above the WACC of 5.40%, implying that the company has consistently created economic value during this period. When looking at the longer-term trends, the company’s ROE, ROIC, and WACC have fluctuated over the past decade, with highs and lows indicating varying levels of performance and cost of capital.

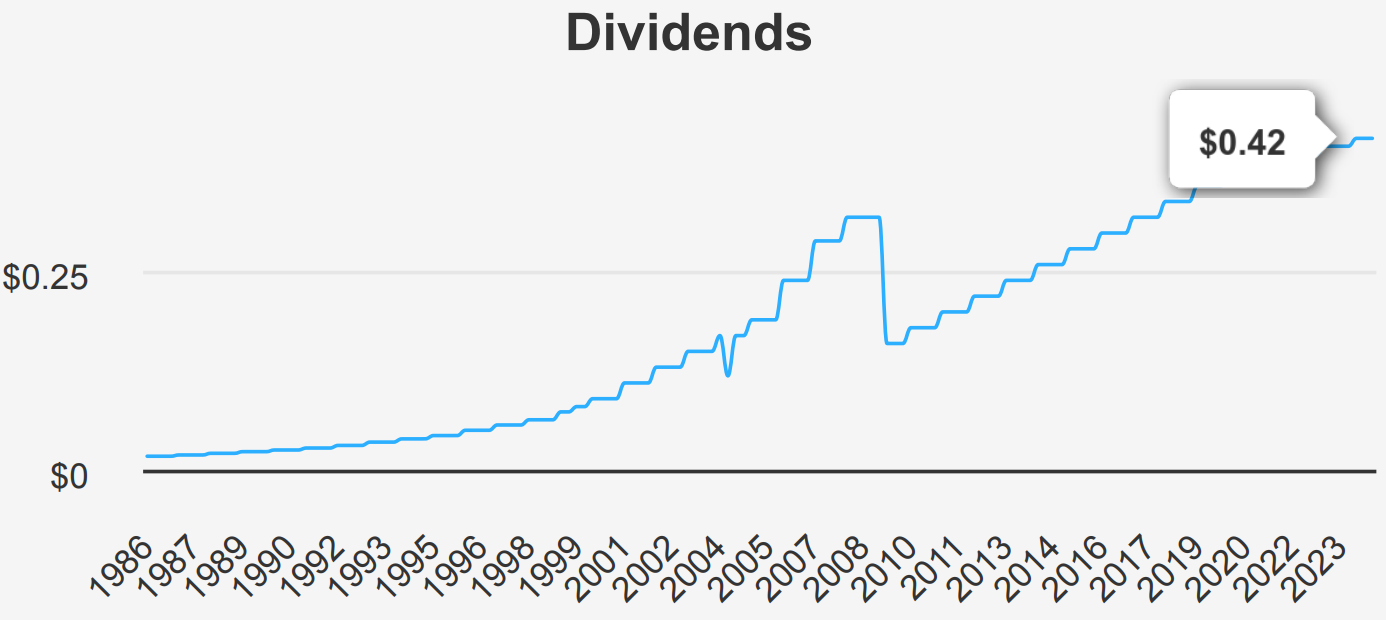

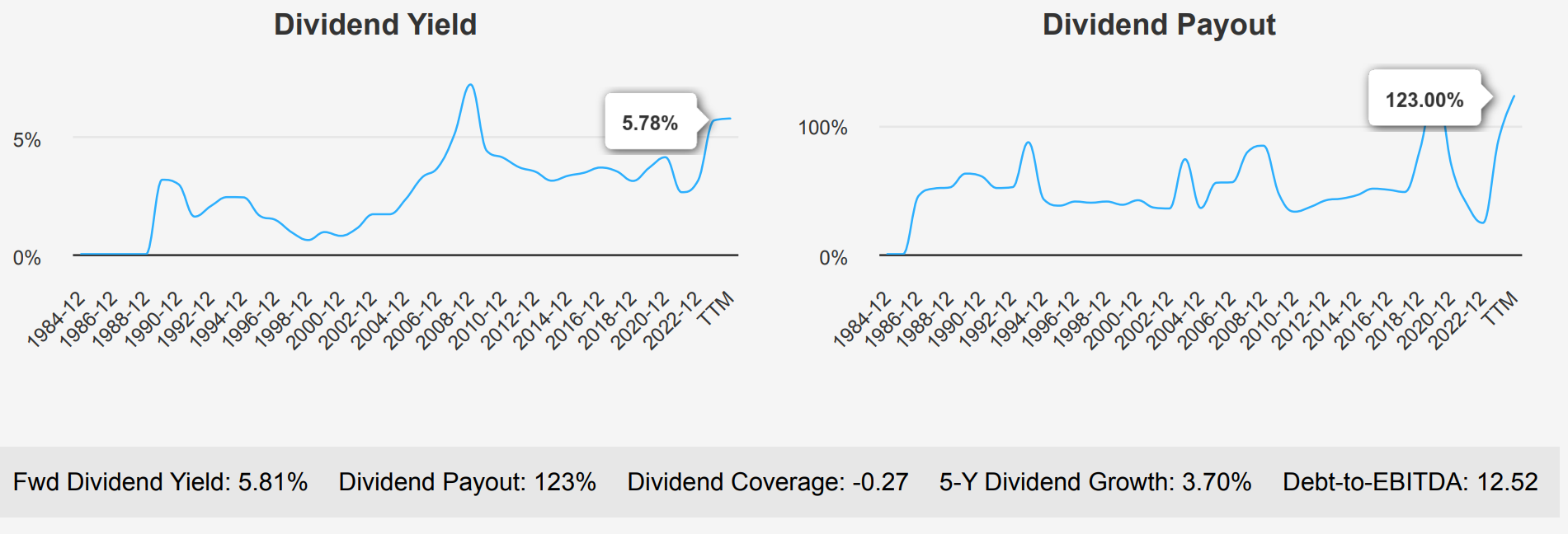

Dividend

Pfizer Inc (PFE) has shown consistent dividend growth over the past few years. The 5-year dividend growth rate stands at 3.70%, while the 3-year growth rate per share is at 2.60%. The forward dividend yield is at a healthy 5.81%. The dividend payout ratio is currently high at 123%. It indicates that retained earnings and current period earnings are being paid out as dividends.

Comparing the dividend performance with the sector, Pfizer’s dividend yield has varied over the past 10 years, with a high of 6.50% and a low of 2.61%, with the median at 3.68%. The company’s Debt-to-EBITDA ratio of 12.52 is high, indicating higher financial risk and raising concerns about its ability to service its debt. Caution may be warranted due to the elevated debt levels.

In conclusion, while Pfizer’s dividend growth has been steady, investors should monitor the high debt levels as reflected by the Debt-to-EBITDA ratio to assess the company’s financial health and ability to sustain its dividend payments in the long term.

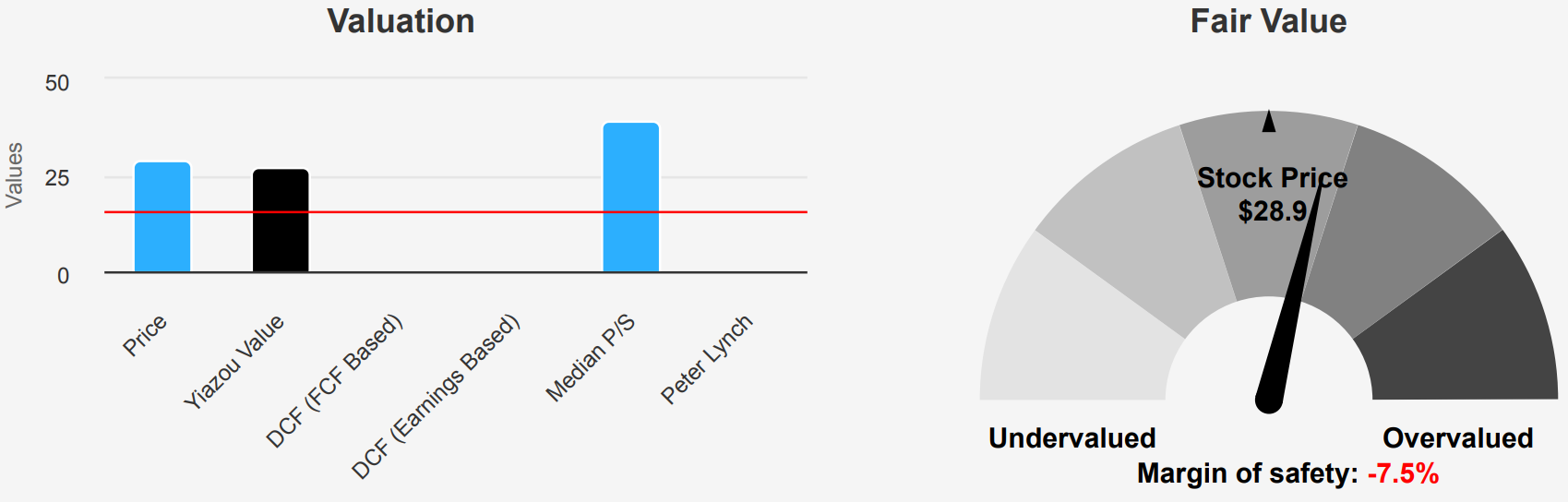

Pfizer Stock Valuation

PFE’s current price is slightly higher than its intrinsic value of $26.88. The P/S ratio of 2.97 and EV/EBITDA of 40.94 suggest that the stock may be overvalued compared to industry averages. The forward PE ratio of 19.11 indicates a higher valuation expectation in the future. When comparing these metrics to its 5-year and 10-year averages, PFE currently seems to be trading at a premium. Investors may want to exercise caution and consider waiting for a more favorable entry point based on the valuation metrics.

Risk & Reward

The risk assessment analysis for PFE stock reveals several concerning indicators. The day inventory warning suggests potential difficulties in selling goods, indicating a possible slowdown in sales. The declining Gross margin and Operating margin raise concerns about the company’s profitability, with both metrics showing significant annual decreases. The high Payout ratio of 1.23 raises doubts about the sustainability of Pfizer Inc’s dividend payments. Additionally, the declining revenue per share and high PS Ratio suggest challenges in generating revenue and potential overvaluation of the stock.

Furthermore, the Z-score of 1.71, falling in the distress zone, raises alarms about the company’s financial health and the possibility of bankruptcy in the next two years. However, the M-score of -2.24 suggests that the company is unlikely to be a manipulator, which is a positive sign. The high Yield, close to a 10-year high, provides some support for investors seeking income.

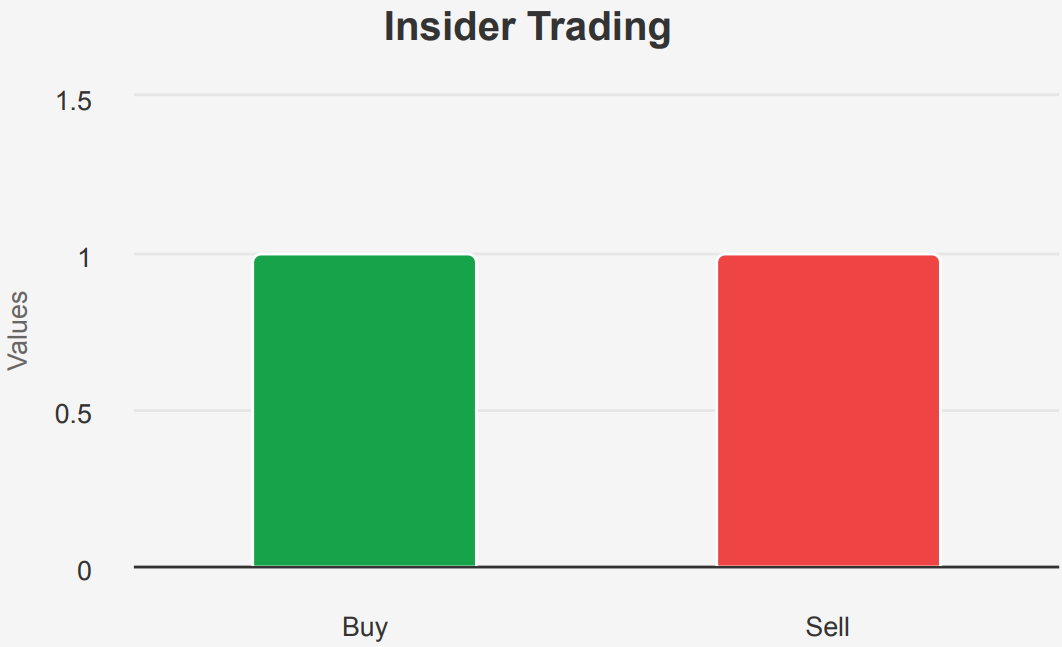

Pfizer Stock Insider Activity

In the past 12 months, there has been minimal insider trading activity in Pfizer Inc. (PFE). Only one insider buy and one insider sell were recorded during this period. The insider ownership stands at 0.28%, indicating that company insiders have a relatively small stake in the company. Conversely, institutional ownership is significantly higher at 66.19%, suggesting that institutional investors hold a substantial portion of PFE’s shares.

The limited insider trading activity may indicate that company directors and management are not actively buying or selling shares, potentially signaling stability or lack of significant developments within the company. However, the high institutional ownership implies that professional investors have confidence in PFE’s prospects. Overall, the insider trading analysis and trend analysis for PFE suggest a relatively stable insider trading environment with strong institutional support.

Liquidity & Trading

Pfizer Inc. (PFE) has a relatively high average daily trade volume of 34,328,801 shares over the past two months, indicating active trading in the stock. The daily trading volume for PFE stands at 21,186,042 shares, demonstrating sufficient liquidity for investors to easily enter and exit positions.

The Dark Pool Index (DPI) for PFE is 20.94%, suggesting that a significant portion of trading activity occurs in dark pools rather than on public exchanges. This indicates that institutional investors may be actively trading PFE shares off-exchange, potentially impacting price discovery and overall market liquidity.

Overall, PFE appears to have robust liquidity and trading activity, with a high average daily trade volume and a notable DPI percentage. Investors should consider these factors when making trading decisions in PFE.

Government Contracts

Pfizer Inc. (PFE) has secured government contracts worth over $1 billion each year from 2019 to 2024. The contract amounts have shown significant growth, with a peak of $18,020,428,142 in 2022. This data reflects Pfizer’s substantial involvement in government contracts. This indicates a strong partnership with government agencies and a significant contribution to public health initiatives.