The Circle of Competence is a core principle that Warren Buffett and his longtime business partner, Charlie Munger, endorsed. This concept emphasizes the importance of understanding and operating within the areas where one’s knowledge and expertise are strongest. As Buffett famously urges:

“Know what you don’t know.”

Understanding the Circle of Competence

The Circle of Competence principle encourages investors to invest in industries and markets familiar to them. If an investor can successfully operate solely under the radar of his expertise, he will make informed decisions for taking risks and seizing opportunities.

The biggest mistake investors make is venturing into unfamiliar territories, often leading to poor strategic decisions and financial losses.

Buffett’s Circle of Competence in Action

Warren Buffett’s investment career is a testament to the power of the Circle of Competence. At Berkshire Hathaway, Buffett has consistently invested in businesses he understands thoroughly.

Here are a few notable examples from his illustrious career:

- Coca-Cola (KO): His understanding of the beverage industry and Coca-Cola’s strong brand and global presence made it a clear choice within his Circle of Competence. Buffett’s extensive research into the company’s history, product line, and competitive edge confirmed his belief in its long-term value. Since his initial investment in 1988, Coca-Cola has been a cornerstone of Berkshire Hathaway’s portfolio, demonstrating Buffett’s commitment to investing in what he knows.

- American Express (AXP): During the 1960s, American Express faced a major crisis known as the “Salad Oil Scandal.” While many investors fled, Buffett’s deep understanding of the company’s core business and strong market position led him to invest heavily. Buffett knew the strength of the brand and the loyalty of its customer base would allow the company to recover. This move paid off enormously as American Express recovered and grew, becoming another long-term holding for Berkshire Hathaway.

- Geico: Buffett’s involvement with Geico began in the 1950s as a young investor. His thorough analysis of the insurance industry and Geico’s unique business model allowed him to see its long-term potential. Buffett’s connection to Geico was also personal; his mentor, Benjamin Graham, was the company’s chairman. This insight led to Berkshire Hathaway’s eventual acquisition of the company, significantly contributing to its success.

Why Buffett Avoided Tech Stocks: Knowing His Limits

For many years, Buffett famously avoided investing in technology stocks. His decision was founded on solid beliefs based on the Circle of Competence principle.

He confessed that he doesn’t understand enough about the complexities and rapid changes happening in the technology sector. In doing so, Buffett remained outside the investment areas where he could make a poor investment.

This conservative approach allowed him to concentrate on industries he knew well, such as consumer goods, insurance, and finance, leading to great success.

Defining Your Circle of Competence

For investors aiming to establish their own Circle of Competence, several factors need consideration:

- Background and Education: Build upon your educational background and professional training. For instance, a technologist-turned-investor would be very familiar with software companies and technological trends.

- Professional Experience: Go deep into your professional experience. Those with finance or healthcare careers or who work in a specific industry will have insights that can help guide investment decisions in those sectors.

- Business and Social Activities: Personal interests and hobbies can also play a role. A car enthusiast might have a deeper understanding of the automotive industry, while someone involved in community activities might recognize retail or consumer behavior trends.

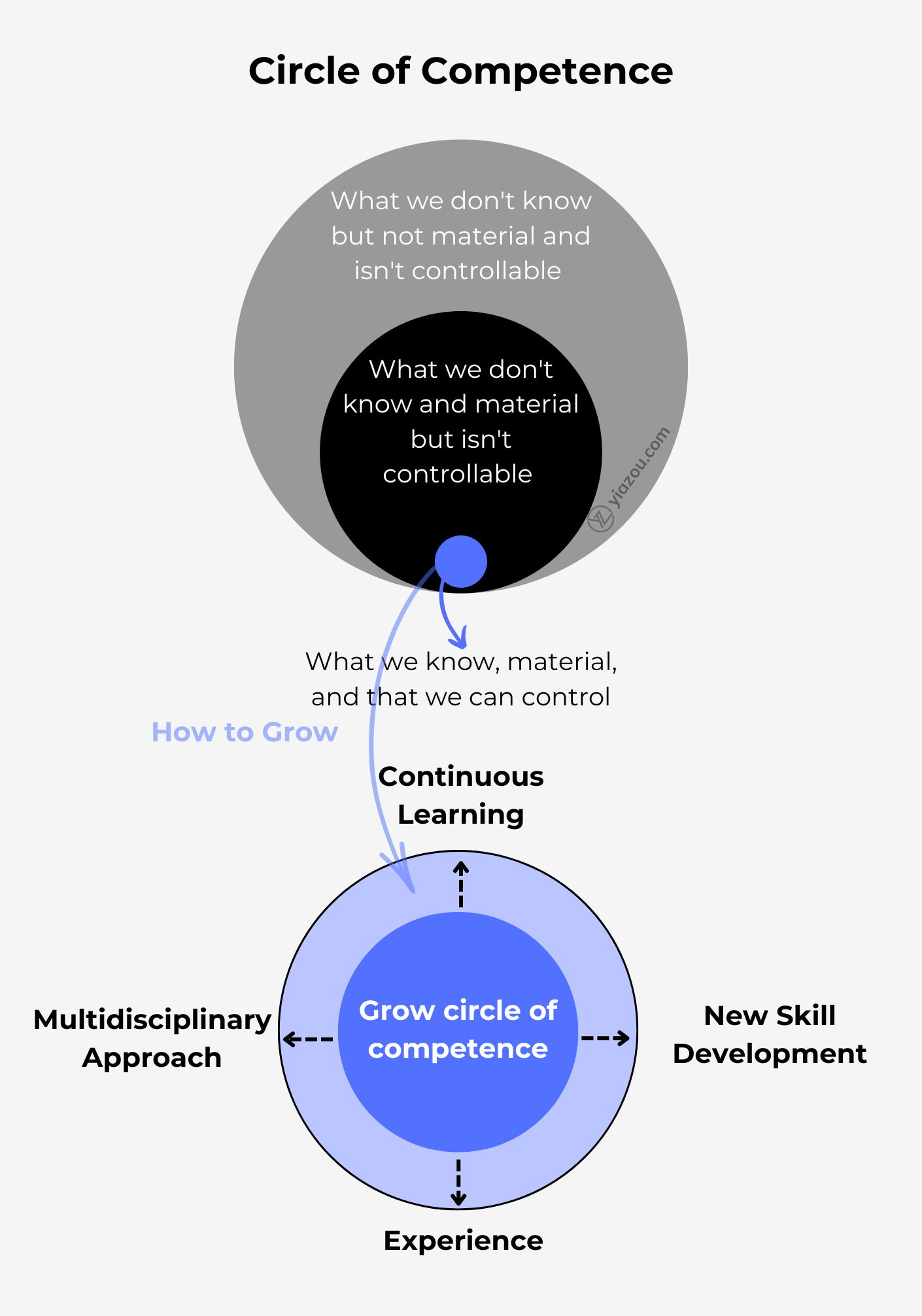

Expanding Your Circle of Competence

While it is crucial to recognize your current Circle of Competence, continuous learning and experience can expand it. Here’s how:

- Study Industries and Companies: Spend time studying industries outside your core competence. Read various industry reports, visit conferences, and study market trends.

- Leverage Expert Knowledge: Connect with those who know. Networking, mentorship, and reading material from authoritative sources give access to people with knowledge and experience. Books, courses, and seminars often provide wisdom and may open your mind and perspective.

- Hands-On Experience: Direct involvement in new areas through side projects, part-time jobs, or hobbyist activities—is a great way to build competence in those sectors.

Conclusion

Warren Buffett’s remarkable investment record attests to the Circle of Competence. The lesson for today’s investor is loud and clear: Stick with your strengths, diversify where you are weakest, invest in what you know best, and never stop learning. This will help avoid many pitfalls and possibly turn up some very nice opportunities for unusually good returns.